HP 39g hp 39g+ (39g & 40g)_mastering the hp 39g+_English_E_F2224-90010.pdf - Page 160

The Finance Aplet, Parameters - user manual

|

View all HP 39g manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 160 highlights

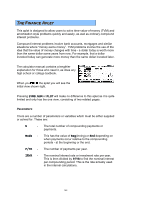

THE FINANCE APLET This aplet is designed to allow users to solve time-value-of-money (TVM) and amortization style problems quickly and easily, as well as ordinary compound interest problems. Compound interest problems involve bank accounts, mortgages and similar situations where "money earns money". TVM problems involve the use of the idea that the value of money changes with time - a dollar today is worth more than the same dollar some years from now. For example, that a dollar invested today can generate more money than the same dollar invested later. The calculator manual contains a lengthier explanation for those who need it, as does any high school or college textbook. When you the aplet you will see the initial view shown right. Pressing SYMB, NUM or PLOT will make no difference to this aplet as it is quite limited and only has the one view, consisting of two related pages. Parameters There are a number of parameters or variables which must be either supplied or solved for. These are: N - The total number of compounding payments or payments. Mode - This has the value of Beg(inning) or End depending on when payments occur relative to the compounding periods - at the beginning or the end. P/YR - The number of payments per year. I%YR - The nominal interest rate or investment rate per year. This is then divided by P/YR to find the nominal interest per compounding period. This is the rate actually used in the internal calculations. 160