Sharp UP-700 Instruction Manual - Page 49

Computation of VAT Value Added Tax/Tax - pos terminal manual

|

View all Sharp UP-700 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 49 highlights

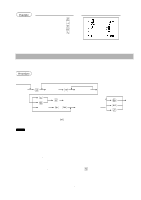

s Mixed-tender sale (cash or check tendering + credit tendering) Example Key operation Print s 950 c Ô h Ò Ó Œ c NOTE Press the through keys or the through keys in place of the key when your customer makes payment by checks or by credit account. Computation of VAT (Value Added Tax)/Tax s VAT/tax system The POS terminal may be programmed for the following six tax systems by your authorized SHARP dealer. Automatic VAT 1 through 6 system (Automatic operation method using programmed percentages) This system, at settlement, calculates VAT for taxable 1, taxable 2, taxable 3, taxable 4, taxable 5, and taxable 6 subtotals by using the corresponding programmed percentages. Automatic tax 1 through 6 system (Automatic operation method using programmed percentages) This system, at settlement, calculates taxes for taxable 1, taxable 2, taxable 3, taxable 4, taxable 5, and taxable 6 subtotals by using the corresponding programmed percentages, and also adds the calculated taxes to those subtotals, respectively. Manual VAT 1 through 6 system (Manual entry method using programmed percentages) Procedure sz This system provides the VAT calculation for taxable 1, taxable 2, taxable 3, taxable 4, taxable 5, and taxable 6 subtotals. This calculation is performed using the corresponding programmed percentages when z s the key is pressed just after the key. Manual VAT 1 system (Manual entry method for subtotals that uses VAT 1 preset percentages) Procedure To use a programmed rate s VAT rate z This system enables the VAT calculation for the then subtotal. This calculation is performed using the VAT 1 z s preset percentages when the key is pressed just after the key. For this system, the keyed-in tax rate can be used. 47