HP 113394 User Guide - Page 138

HP 113394 - 12C Platinum Calculator Manual

|

UPC - 808736340502

View all HP 113394 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 138 highlights

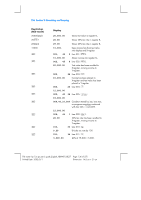

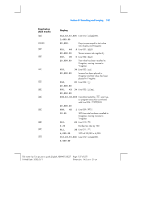

138 Section 9: Branching and Looping Keystrokes (ALG mode) 25000 Ê Ê Ê Ê Ê Ê Ê Ê Ê Display 25,000. 001, 44 Keys income greater than test value into display and X-register. 9 Line 001: ?9. 25,000.00 002, 45 Stores income into register R9. 0 Line 002: :0. 20,000.00 003, Test value has been recalled to X-register, moving income to Y-register. 34 Line 003: ~. 25,000.00 004, Income has been placed in X-register and test value has been placed in Y-register. 20 Line 004: §. 25,000.00 005, 43 34 Line 005: go. 25,000.00 007, 45 2 Condition tested by o was false, so program execution skipped the next line and continued at line 007: :2. 25.00 25% tax rate has been recalled to X-register, moving income to Y-register. 008,43, 33,010 Line 008: gi010. 25.00 010, 25 Line 010: b. 0.25 011, Divides tax rate by 100. 36 Line 011: }. 6,250.00 25% of 25,000 = 6,250. File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 138 of 275 Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm