HP 113394 User Guide - Page 193

Group, of Months, Cash Flow

|

UPC - 808736340502

View all HP 113394 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 193 highlights

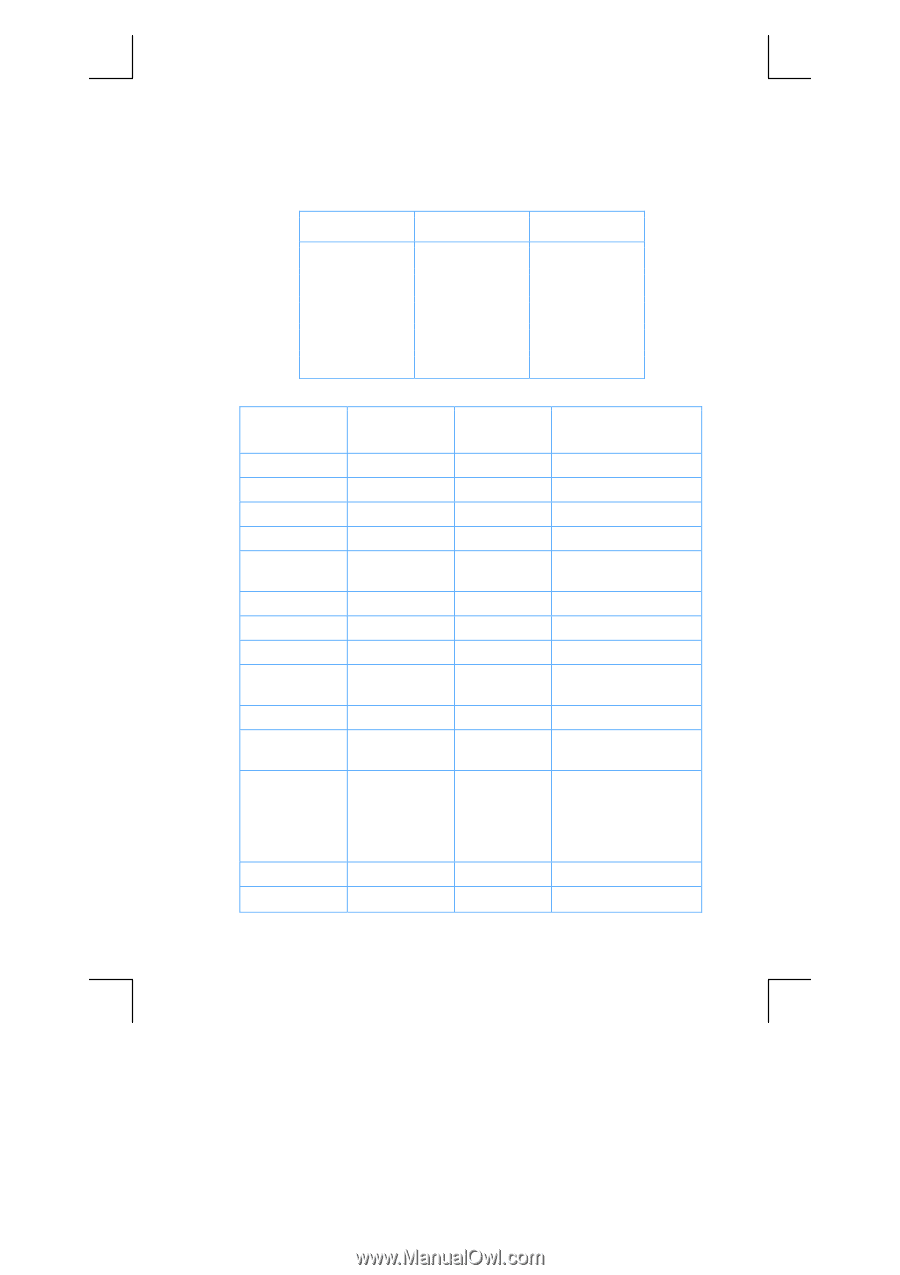

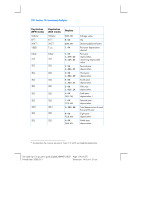

Section 13: Investment Analysis 193 Example: An investor has the following unconventional investment opportunity. The cash flows are: Group # of Months Cash Flow ($) 0 1 -180,000 1 5 100,000 2 5 -100,000 3 9 0 4 1 200,000 Calculate the MIRR using a safe rate of 6% and a reinvestment (risk) rate of 10%. Keystrokes (RPN mode) Keystrokes (ALG mode) Display f] f[ fCLEARH 0gJ 100000gK 5ga 0gK5ga 0gK9ga 200000gK fCLEARH 0gJ 100000gK 5ga 0gK5ga 0gK9ga 200000gK 0.00 0.00 100,000.00 5.00 5.00 9.00 200,000.00 First cash flow. Second through sixth cash flows. Next five cash flows. Next nine cash flows. Last cash flow. 10gCfl 10gCfl 657,152.37 NPV of positive cash flows. Þ$ Þ$ -657,152.37 20nM 20nM 775,797.83 NFV of positive cash flows. 180000Þg 180000Þg NPV of negative cash J0gK5g J0gK5g flows. a100000Þ a100000Þ gK5ga6 gK5ga gCfl 6gCfl -660,454.55 20n¼ 12§ 20n¼ §12³ 0.81 9.70 Monthly MIRR Annual MIRR. File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 193 of 275 Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm