HP 113394 User Guide - Page 169

Deferred Annuities

|

UPC - 808736340502

View all HP 113394 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 169 highlights

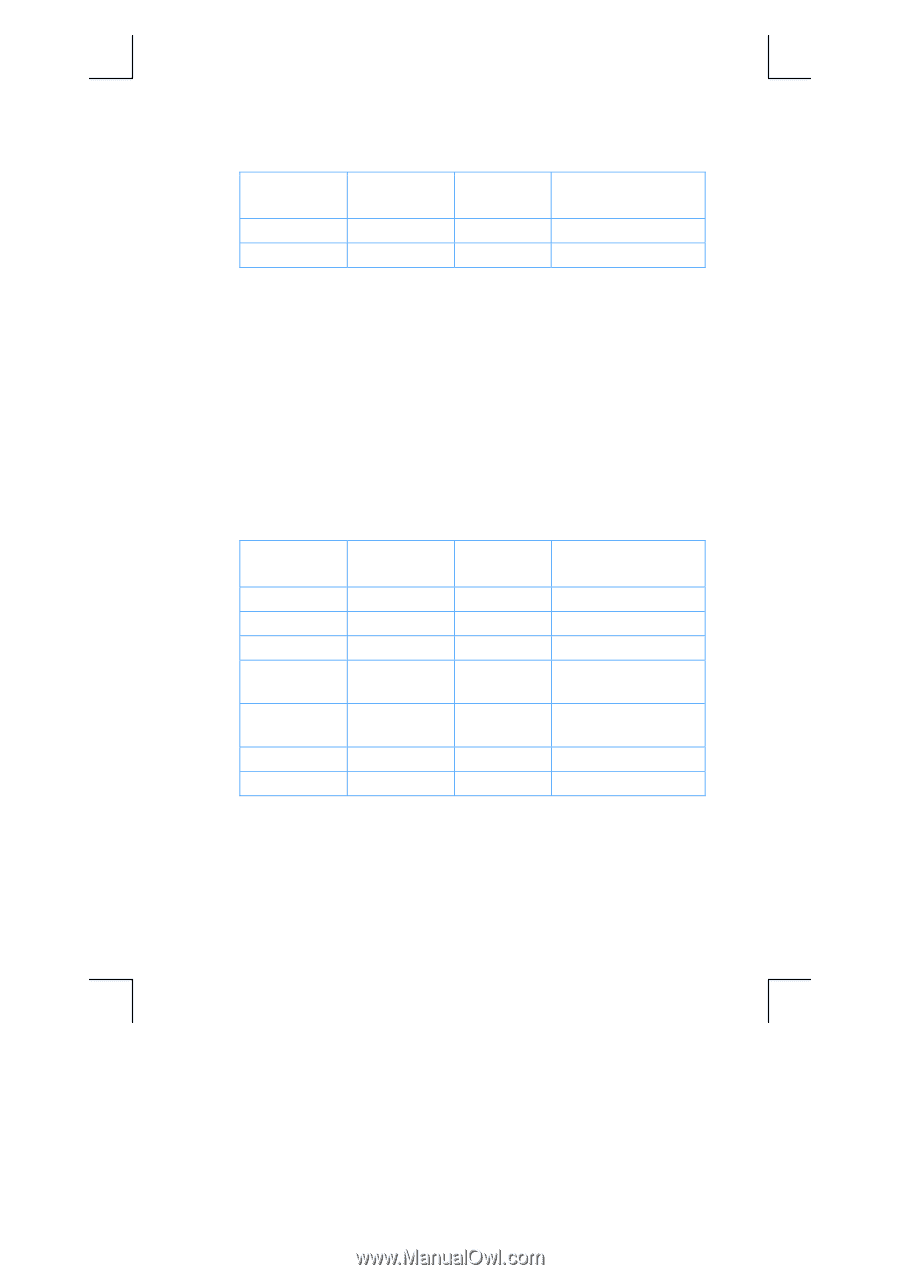

Section 12: Real Estate and Lending 169 Keystrokes (RPN mode) t t Keystrokes (ALG mode) t t Display 8.57 46,048.61 Yield. Balance in savings. By purchasing a house, you would gain $7,047.04 (53,095.65 - 46,048.61) over an alternate investment at 3% interest. Deferred Annuities Sometimes transactions are established where payments do not begin for a specified number of periods; the payments are deferred. The technique for calculating NPV may be applied assuming zero for the first cash flow. Refer to pages 73 through 77. Example 1: You have just inherited $20,000 and wish to put some of it aside for your daughter's college education. You estimate that when she is of college age, 9 years from now, she will need $7,000 at the beginning of each year for 4 years for college tuition and expenses. You wish to establish a fund which earns 6% annually. How much do you need to deposit in the fund today to meet your daughter's educational expenses? Keystrokes (RPN mode) f] fCLEARH 0gJ 0gK 8ga 7000gK 4ga 6¼ fl Keystrokes (ALG mode) f[ fCLEARH 0gJ 0gK 8ga 7000gK 4ga 6¼ fl Display 0.00 0.00 0.00 8.00 7,000.00 4.00 6.00 15,218.35 Initialize. First cash flow. Second through ninth cash flows. Tenth through thirteenth cash flows. Interest. NPV. Leases often call for periodic contractual adjustments of rental payments. For example, a 2-year lease calls for monthly payments (at the beginning of the month) of $500 per month for the first 6 months, $600 per month for the next 12 months, and $750 per month for the last 6 months. This situation illustrates what is called a "step-up" lease. A "step-down" lease is similar, except that rental payments are decreased periodically according to the lease contract. Lease payments are made at the beginning of the period. File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 169 of 275 Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm