HP 113394 User Guide - Page 191

Excess Depreciation

|

UPC - 808736340502

View all HP 113394 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 191 highlights

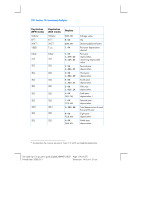

Section 13: Investment Analysis 191 Excess Depreciation When accelerated depreciation is used, the difference between total depreciation charged over a given period of time and the total amount that would have been charged under straight-line depreciation is called excess depreciation. To obtain excess depreciation: RPN Mode: 1. Calculate the total depreciation then press \. 2. Key in the depreciable amount (cost less salvage) then press \. Key in the useful life of the asset in years then press z. Key in the number of years in the income projection period then press § to get the total straight-line depreciation charge. 3. Press - to get the excess depreciation. ALG Mode: 1. Calculate the total depreciation then press -gØ. 2. Key in the depreciable amount (cost less salvage) then press z. Key in the useful life of the asset in years then press §. Key in the number of years in the income projection period then press gÙ to get the total straight-line depreciation charge. 3. Press ³ to get the excess depreciation. Example: What is the excess depreciation in the previous example over 7 calendar years? (Because of the partial first year, there are 6.5 years depreciation in the first 7 calendar years.) Keystrokes (RPN mode) 9429.56\ 10500\ 8z 6.5§ - Keystrokes (ALG mode) Display 9429.56-gØ 9,429.56 10500z 8§ 10,500.00 1,312.50 6.5 gÙ 8,531.25 ³ 898.31 Total depreciation through seventh year. Depreciable amount. Yearly straight-line depreciation. Total straight-line depreciation. Excess depreciation File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 191 of 275 Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm