Casio PCR T2000 Owners Manual - Page 15

province use the same tax rate as another province, inputting the wrong data will result incorrect

|

UPC - 079767505226

View all Casio PCR T2000 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 15 highlights

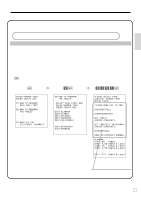

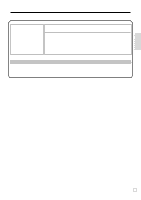

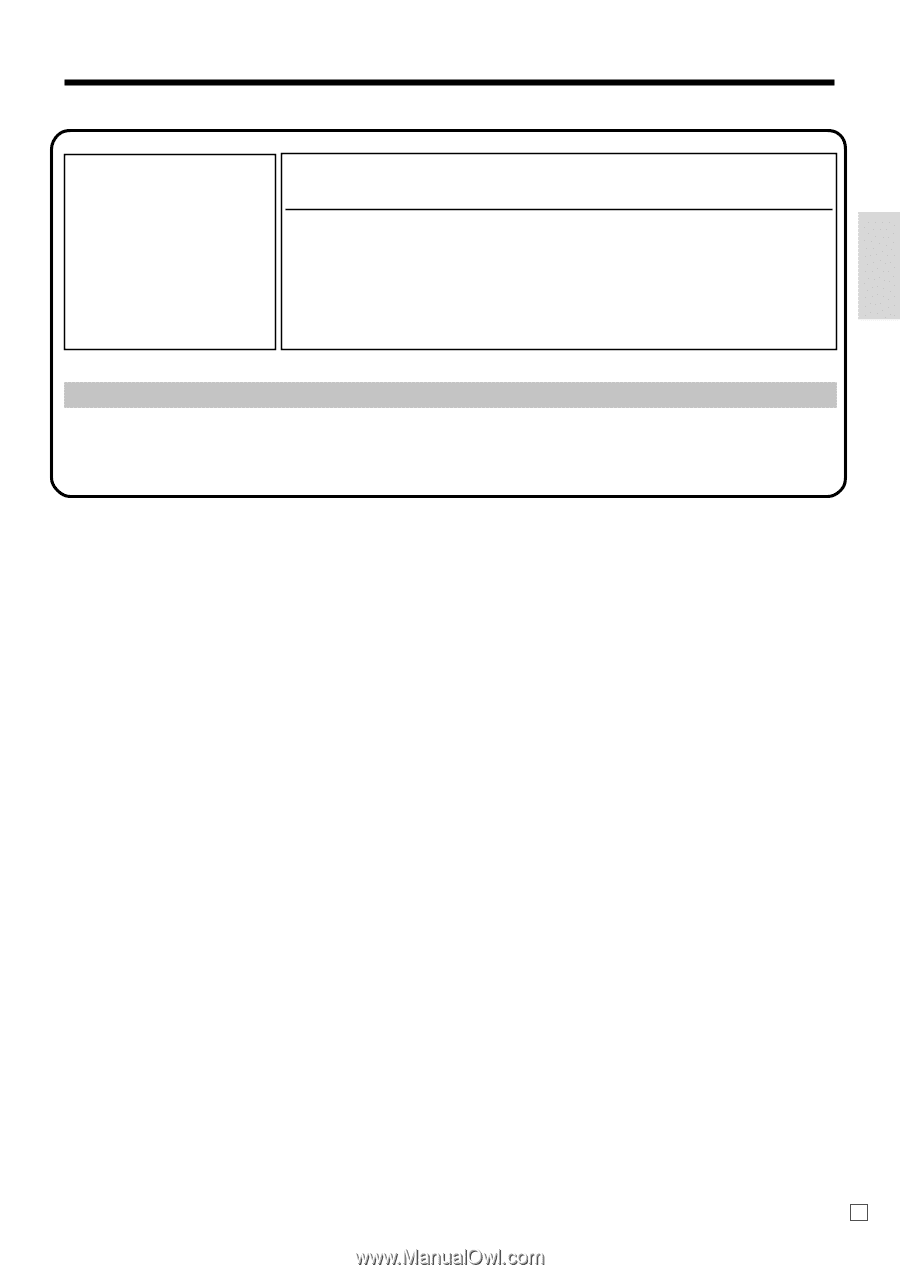

CANADIAN TAX TABLES * Must be programmed into Tax table 2 ~ 4. * * * * * * * NOVA ONTARIO QUEBEC NEW ONTARIO BRITISH MANITOBA/ ONTARIO N.B. & QUEBEC SCOTIA FOUNDLAND COLUMBIA SASKATCHEWAN P.E.I 10% 10% 10% 12% 12% 6% 6% 7% 8% 9% 10 10 10 12 0 0 5004 5004 5004 5004 1 1 4 2 25 14 25 24 25 41 29 58 37 74 45 54 6 5002 7 0 5002 1 3 25 25 31 43 56 9 9002 Important! Be sure you use the federal sales tax data with your provincial sales tax data. Even if your province use the same tax rate as another province, inputting the wrong data will result incorrect tax calculations. Getting Started 15 E

15

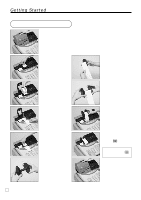

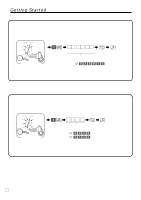

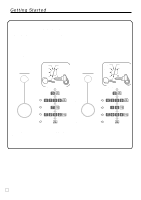

Getting Started

E

*

NOVA

SCOTIA

10%

10

5004

*

ONTARIO

10%

10

5004

*

QUEBEC

10%

10

5004

*

NEW

FOUNDLAND

12%

12

5004

*

BRITISH

COLUMBIA

6%

0

1

2

14

24

41

58

74

MANITOBA

/

SASKATCHEWAN

6%

6

5002

*

ONTARIO

12%

0

1

4

25

25

25

29

37

45

54

ONTARIO

7%

7

5002

*

N.B. &

P.E.I

8%

0

1

3

25

25

31

43

56

QUEBEC

9%

9

9002

CANADIAN TAX TABLES

* Must be programmed into Tax

table 2 ~ 4.

Important

!

Be sure you use the federal sales tax data with your provincial sales tax data. Even if your

province use the same tax rate as another province, inputting the wrong data will result incorrect

tax calculations.