Casio PCR T2000 Owners Manual - Page 33

Preparing and using reductions - tax table

|

UPC - 079767505226

View all Casio PCR T2000 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 33 highlights

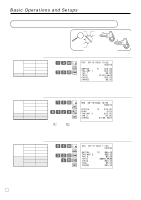

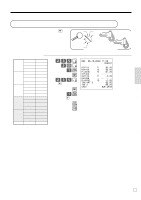

Basic Operations and Setups Preparing and using reductions This section describes how to prepare and register reductions. Programming for reductions You can use the m key to reduce single item or subtotal amounts. The following procedure lets you program the tax calculation method for the m key. To program tax calculation status CAL X REG Z OFF RF PGM Mode Switch PGM C-A32 { } t (Tax table 1) T (Tax table 2) k (Tax table 3) e (Tax table 4)† 61s 6 tT ke (Tax table 1, 2, 3 and 4†) 6 m 6s B (Non tax) Note: Tax symbols T1: Tax table 1 T2: Tax table 2 T3: Tax table 3 T4: Tax table 4 †(only for the Canadian model) *: All taxable m is initialized as non-tax. Taxable status of the m key The tax calculation for the reduction amount is performed in accordance with the tax status programmed for the m key, regardless of whether the reduction is performed on the last item registered or a subtotal amount. To program preset reduction amount CAL X REG Z OFF RF PGM Mode Switch PGM C-A32 6 1s 6 6m 6 s Unit price Example: $1.00 2 100 $10.25 2 1025 $1,234.56 2 123456 33 E