Sharp XE A302 XE-A302 Operation Manual in English and Spanish - Page 23

Tax status shift, In case of; Tax 1: PST, Tax 2: PST - can t program

|

UPC - 074000048294

View all Sharp XE A302 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 23 highlights

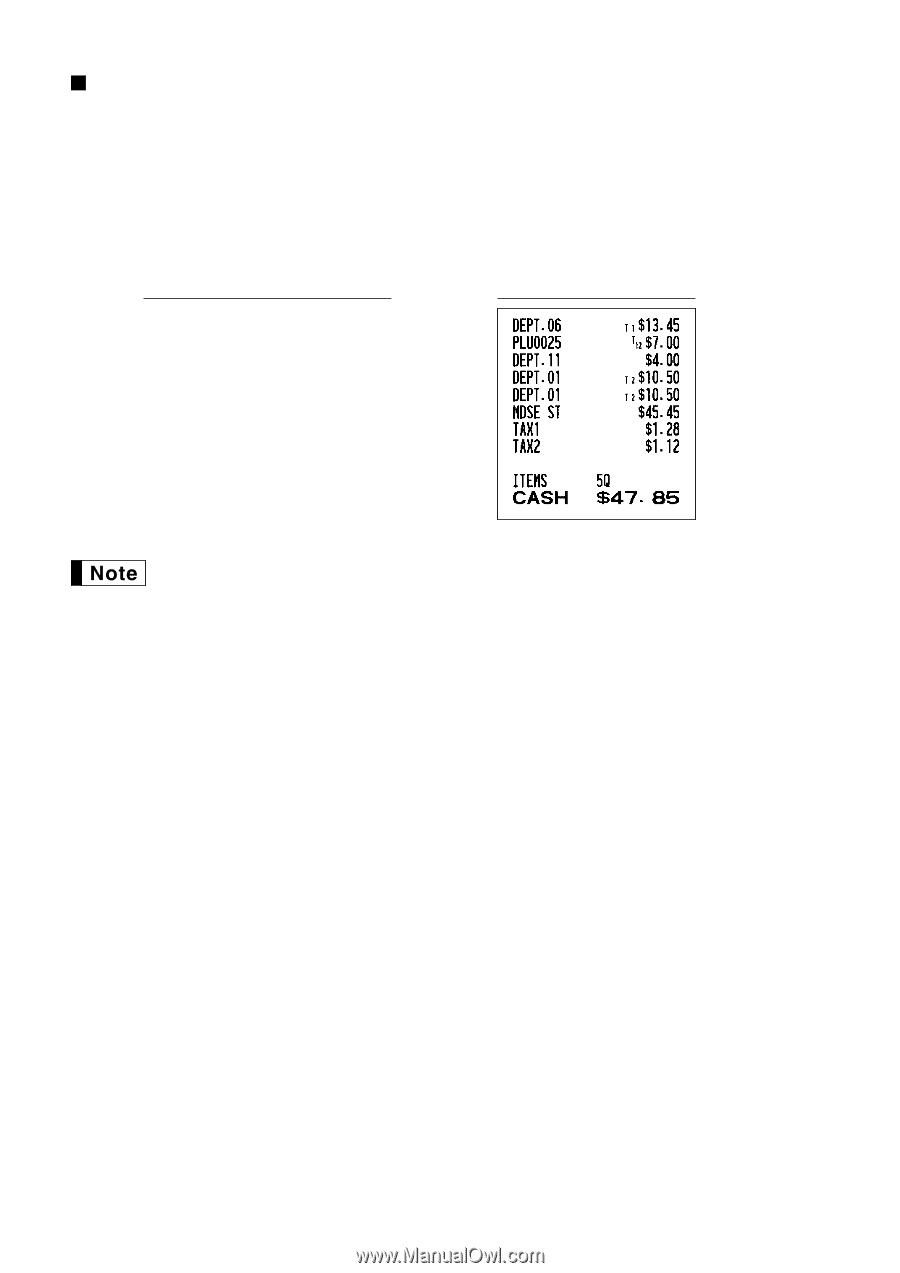

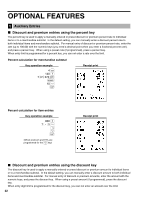

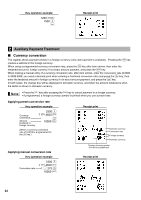

Tax status shift The machine allows you to shift the programmed tax status of each department or PLU/subdepartment by T U pressing the and/or keys before those keys. After each entry is completed, the programmed tax status of each key is resumed. Example: Selling the following items for cash with their programmed tax status reversed • One $13.45 item of dept. 6 (non-taxable) as a taxable 1 item • One $7.00 item of PLU 25 (non-taxable) as a taxable 1 and 2 item • One $4.00 item of dept. 11 (taxable 2) as a non-taxable item • Two $10.50 items of dept. 1 (taxable 1) as taxable 2 items Key operation example Receipt print 1345 T ( TU› 11 U d 400 d 1050 T U ! ! A When Canadian tax system is applied: When using a tax status shift, the entry of a multi-taxable item for PST or GST will be prohibited. Please see below: In case of; Tax 1: PST, Tax 2: PST, Tax 3: PST, Tax 4: GST Taxable 1 and 2 item prohibited Taxable 1 and 3 item prohibited Taxable 2 and 3 item prohibited Taxable 1 and 4 item allowed Taxable 2 and 4 item allowed Taxable 3 and 4 item allowed In case of; Tax 1: PST, Tax 2: PST, Tax 3: GST, Tax 4: GST Taxable 1 and 2 item prohibited Taxable 1 and 3 item allowed Taxable 2 and 3 item allowed Taxable 1 and 4 item allowed Taxable 2 and 4 item allowed Taxable 3 and 4 item prohibited 21