Sharp XE A302 XE-A302 Operation Manual in English and Spanish - Page 31

Time, 2. Tax Programming for Automatic Tax Calculation Function, Tax programming using a tax rate - support

|

UPC - 074000048294

View all Sharp XE A302 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 31 highlights

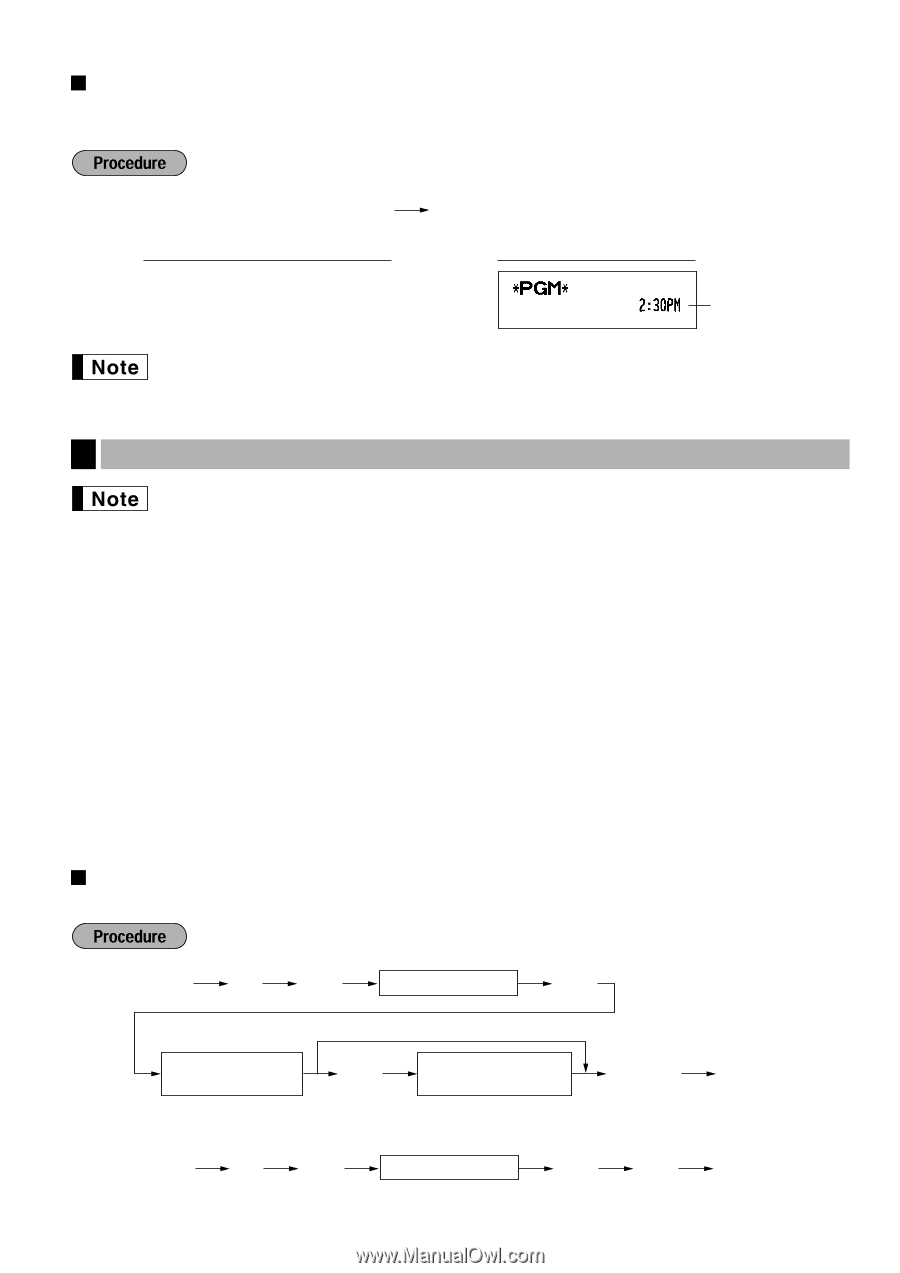

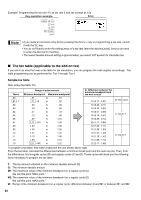

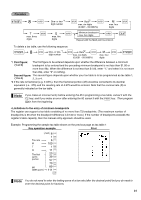

Time For setting the time, enter the time in 4 digits using the 24-hour format. For example, when the time is set to 2:30 AM, enter 230; and when it is set to 2:30 PM, enter 1430. Time(max. 4 digits in 24-hour format) s Key operation example 1430 s Print Time For display and print,12-hour format is applied by default. To change it to 24-hour format, refer to "Various Function Selection Programming 1" section (Job code 61). 2 Tax Programming for Automatic Tax Calculation Function The cash register can support US and Canadian tax systems. If you use the Canadian tax system, you must first change the tax system, then program the tax rate or tax table and quantity for doughnut exempt which are described in this section. For changing the cash register's tax system, please refer to "Various Function Selection Programming 1" section (job code 70). Before you can proceed with registration of sales, you must first program the tax that is levied in accordance with the law of your state. The cash register comes with the ability to program four different tax rates. In most states, you will only need to program Tax 1. However if you live in an area that has a separate local tax (such as a Parish tax) or a hospitality tax, the register can be programmed to calculate these separate taxes. When you program the tax status for a department, tax will automatically be added to sales of items assigned to the department according to the programmed tax status for the department. You can also enter tax manually. There are two tax programming methods. The tax rate method uses a straight percentage rate per dollar. The tax table method requires tax break information from your state or local tax offices. Use the method which is acceptable in your state. You can obtain necessary data for tax programming from your local tax office. Tax programming using a tax rate The percent rate specified here is used for tax calculation on taxable subtotals. s 9 @ Tax number (1 to 4) @ Tax rate (0.0000 to 100.0000) When the lowest taxable amount is zero @ Lowest taxable amount (0.01 to 999.99) s A To delete a tax rate, use the following sequence: s 9 @ Tax number (1 to 4) @vA 29