Texas Instruments BA-20 Profit Manager User Manual - Page 31

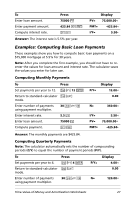

Examples: Computing Basic Loan Payments, Computing Monthly Payments

|

View all Texas Instruments BA-20 Profit Manager manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 31 highlights

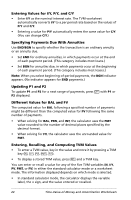

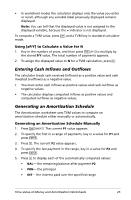

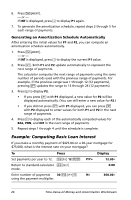

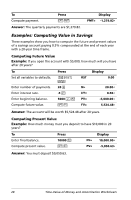

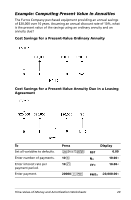

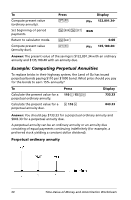

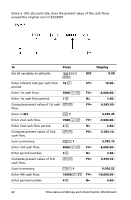

To Enter loan amount. Enter payment amount. Compute interest rate. Press 75000 . 425.84 S / % - Answer: The interest rate is 5.5% per year. Display PV= 75,000.00õ PMT= -425.84 I/Y= 5.50 Examples: Computing Basic Loan Payments These examples show you how to compute basic loan payments on a $75,000 mortgage at 5.5% for 30 years. Note: After you complete the first example, you should not have to reenter the values for loan amount and interest rate. The calculator saves the values you enter for later use. Computing Monthly Payments To Press Set payments per year to 12. & [ 12 ! Return to standard-calculator & U mode. Enter number of payments using payment multiplier. 30 & Z , Enter interest rate. 5.5 - Enter loan amount. 75000 . Compute payment. % / P/Y= Display 12.00 0.00 N= 360.00 I/Y= PV= PMT= 5.50 75,000.00õ -425.84 Answer: The monthly payments are $425.84. Computing Quarterly Payments Note: The calculator automatically sets the number of compounding periods (C/Y) to equal the number of payment periods (P/Y). To Set payments per year to 4. Return to standard-calculator mode. Enter number of payments using payment multiplier. Press &[ 4 ! & U 30 & Z , P/Y= Display 4.00 0.00 N= 120.00 Time-Value-of-Money and Amortization Worksheets 27