Texas Instruments BA-20 Profit Manager User Manual - Page 77

Comparing the Nominal Interest Rate of Investments, Resetting Variables, Converting Variables,

|

View all Texas Instruments BA-20 Profit Manager manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 77 highlights

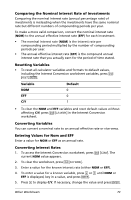

Comparing the Nominal Interest Rate of Investments Comparing the nominal interest rate (annual percentage rate) of investments is misleading when the investments have the same nominal rate but different numbers of compounding periods per year. To make a more valid comparison, convert the nominal interest rate (NOM) to the annual effective interest rate (EFF) for each investment. • The nominal interest rate (NOM) is the interest rate per compounding period multiplied by the number of compounding periods per year. • The annual effective interest rate (EFF) is the compound annual interest rate that you actually earn for the period of time stated. Resetting Variables • To reset all calculator variables and formats to default values, including the Interest Conversion worksheet variables, press & } !. Variable NOM EFF C/Y Default 0 0 1 • To clear the NOM and EFF variables and reset default values without affecting C/Y, press & z in the Interest Conversion worksheet. Converting Variables You can convert a nominal rate to an annual effective rate or vice versa. Entering Values for Nom and EFF Enter a value for NOM or EFF as an annual rate. Converting Interest Rates 1. To access the Interest Conversion worksheet, press & v. The current NOM value appears. 2. To clear the worksheet, press & z. 3. Enter a value for the known interest rate (either NOM or EFF). 4. To enter a value for a known variable, press # or " until NOM or EFF is displayed, key in a value, and press !. 5. Press # to display C/Y. If necessary, change the value and press !. Other Worksheets 73