Texas Instruments BA-20 Profit Manager User Manual - Page 52

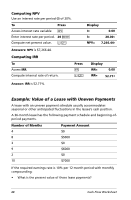

Example: Value of a Lease with Uneven Payments

|

View all Texas Instruments BA-20 Profit Manager manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 52 highlights

Computing NPV Use an interest rate per period (I) of 20%. To Press Access interest rate variable ( Enter interest rate per period. 20 ! Compute net present value. # % Display I= 0.00 I= 20.00 NPV= 7,266.44 Answers: NPV is $7,266.44. Computing IRR To Access IRR. Compute internal rate of return. Press ) # % Display IRR= 0.00 IRR= 52.71 Answer: IRR is 52.71%. Example: Value of a Lease with Uneven Payments A lease with an uneven payment schedule usually accommodates seasonal or other anticipated fluctuations in the lessee's cash position. A 36-month lease has the following payment schedule and beginning-ofperiod payments. Number of Months Payment Amount 4 $0 8 $5000 3 $0 9 $6000 2 $0 10 $7000 If the required earnings rate is 10% per 12-month period with monthly compounding: • What is the present value of these lease payments? 48 Cash Flow Worksheet