Texas Instruments BA-20 Profit Manager User Manual - Page 36

Press, Display, Enter 2nd cash flow.

|

View all Texas Instruments BA-20 Profit Manager manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 36 highlights

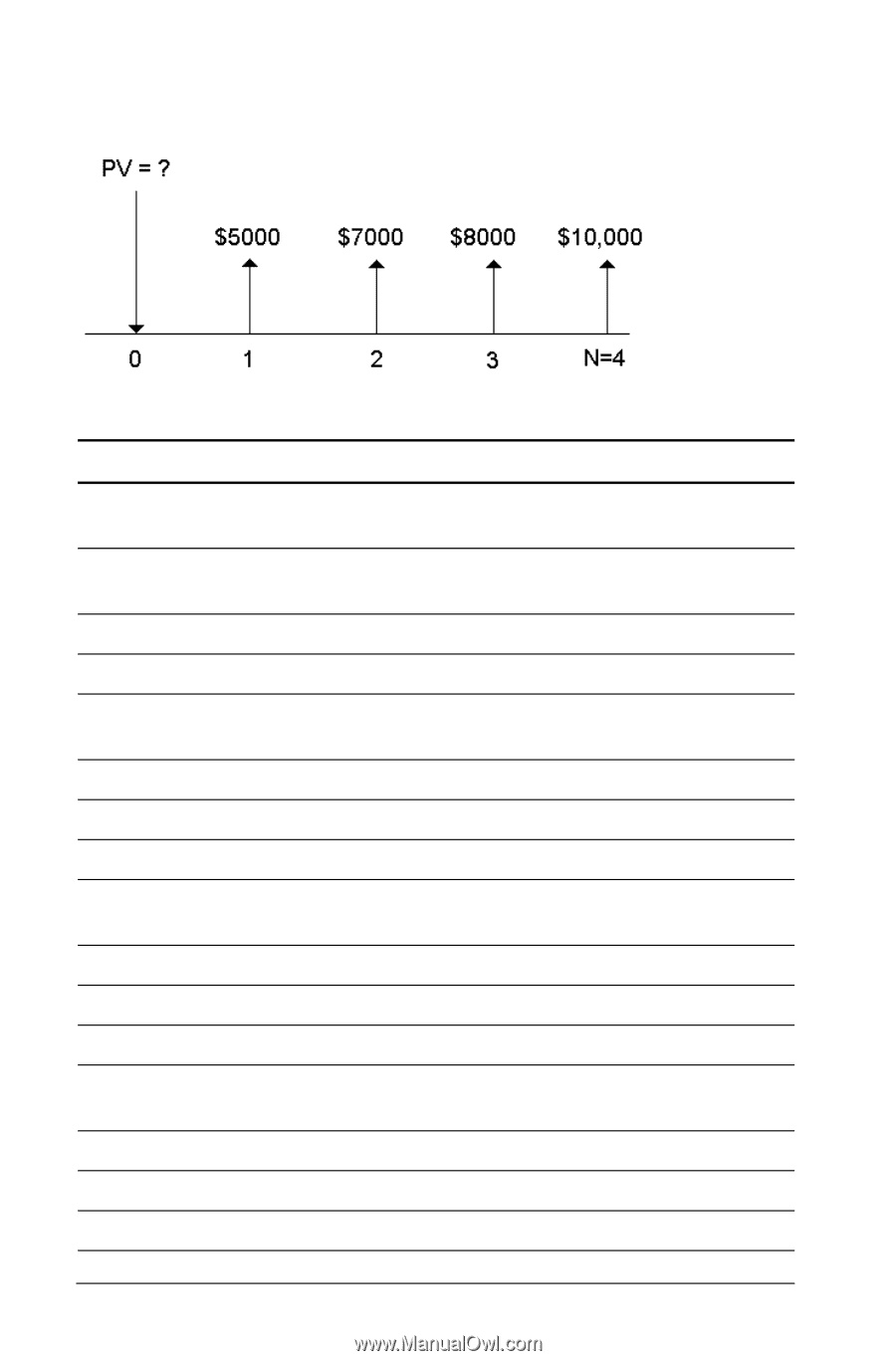

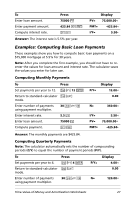

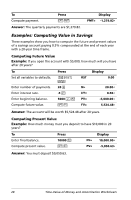

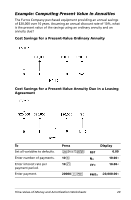

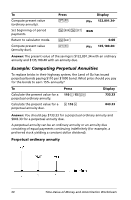

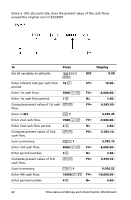

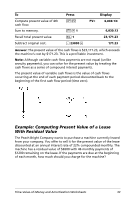

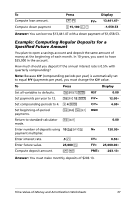

Given a 10% discount rate, does the present value of the cash flows exceed the original cost of $23,000? To Press Set all variables to defaults. & } RST ! Enter interest rate per cash flow 10 - I/Y= period. Enter 1st cash flow. 5000 S 0 FV= Enter 1st cash flow period. 1 , N= Compute present value of 1st cash % . PV= flow. Store in M1. D 1 Enter 2nd cash flow. 7000 S 0 FV= Enter 2nd cash flow period. 2 , N= Compute present value of 2nd % . PV= cash flow. Sum to memory. DH 1 Enter 3rd cash flow. 8000 S 0 FV= Enter period number. 3 , N= Compute present value of 3rd % . PV= cash flow. Sum to memory. DH 1 Enter 4th cash flow. 10000 S 0 FV= Enter period number. 4 , N= Display 0.00 10.00 -5,000.00 1.00 4,545.45 4,545.45 -7,000.00 2.00 5,785.12 5,785.12 -8,000.00 3.00 6,010.52 6,010.52 -10,000.00 4.00 32 Time-Value-of-Money and Amortization Worksheets