Texas Instruments BA-20 Profit Manager User Manual - Page 35

Example: Computing Present Value of Variable Cash Flows, Because the term 1 + I/Y / 100

|

View all Texas Instruments BA-20 Profit Manager manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 35 highlights

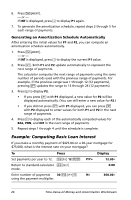

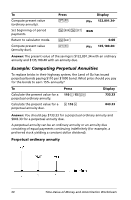

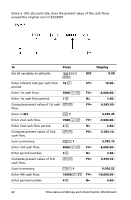

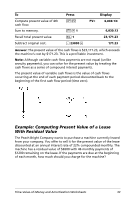

Perpetual annuity due Because the term (1 + I/Y / 100)-N in the present value annuity equations approaches zero as N increases, you can use these equations to solve for the present value of a perpetual annuity: • Perpetual ordinary annuity PV = (---I--/--Y-P---)-M---÷---T--1---0---0- • Perpetual annuity due PV = PMT + (---I--/--Y--P--)--M--⁄--1-T--0---0-----) Example: Computing Present Value of Variable Cash Flows The ABC Company purchased a machine that will save these end-of-year amounts: Year 1 2 3 4 Amount $5000 $7000 $8000 $10000 Time-Value-of-Money and Amortization Worksheets 31

Time-Value-of-Money and Amortization Worksheets

31

Perpetual annuity due

Because the term (1 + I/Y / 100)

-

N

in the present value annuity equations

approaches zero as N increases, you can use these equations to solve for

the present value of a perpetual annuity:

•

Perpetual ordinary annuity

•

Perpetual annuity due

Example: Computing Present Value of Variable

Cash Flows

The ABC Company purchased a machine that will save these end-of-year

amounts:

Year

1

2

3

4

Amount

$5000

$7000

$8000

$10000

PV

PMT

I/Y

(

)

100

÷

---------------------------

=

PV

PMT

PMT

I/Y

(

)

100

)

⁄

----------------------------

+

=