Texas Instruments BA-20 Profit Manager User Manual - Page 43

Example: Computing Payment, Interest, and Loan Balance After a Specified Payment

|

View all Texas Instruments BA-20 Profit Manager manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 43 highlights

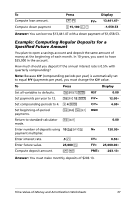

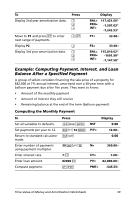

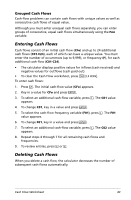

To Display 2nd year amortization data. Press # # # Move to P1 and press % to enter next range of payments. Display P2. Display 3rd year amortization data. # % # # # # Display BAL= PRN= INT= 117,421.60* _-1,507.03* -7,242.53* P1= 22.00 P2= 33.00 BAL= 115,819.62* PRN= -1601.98* INT= -7,147.58* Example: Computing Payment, Interest, and Loan Balance After a Specified Payment A group of sellers considers financing the sale price of a property for $82,000 at 7% annual interest, amortized over a 30-year term with a balloon payment due after five years. They want to know: • Amount of the monthly payment • Amount of interest they will receive • Remaining balance at the end of the term (balloon payment) Computing the Monthly Payment To Set all variables to defaults. Set payments per year to 12. Return to standard-calculator mode. Enter number of payments using payment multiplier. Enter interest rate. Enter loan amount. Compute payment. Press & } ! & [ 12 ! & U 30 & Z , 7 82000 . % / RST P/Y= Display 0.00 12.00 0.00 N= 360.00 I/Y= PV= PMT= 7.00 82,000.00 -545.55 Time-Value-of-Money and Amortization Worksheets 39