Texas Instruments BA-20 Profit Manager User Manual - Page 92

Depreciation, accrued interest

|

View all Texas Instruments BA-20 Profit Manager manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 92 highlights

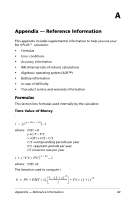

Price (given yield) with more than one coupon period to redemption: PRI = R----V ⎛ ⎝ 1 + M-Y---⎠⎞ N - 1 + D-----S----C-E - 100 × -R--- × A--ME + N 100 × -R--- M K = 1 ⎝⎛1 + M-Y---⎠⎞ K - 1 + D-----S----C-E where: N =number of coupons payable between settlement date and redemption date (maturity date, call date, put date, etc.). (If this number contains a fraction, raise it to the next whole number; for example, 2.4 = 3) DSC =number of days from settlement date to next coupon date K =summation counter Note: The first term computes present value of the redemption amount, not including interest. The second term computes the present values for all future coupon payments. The third term computes the accrued interest agreed to be paid to the seller. Yield (given price) with more than one coupon period to redemption: Yield is found through an iterative search process using the "Price with more than one coupon period to redemption" formula. Accrued interest for securities with standard coupons or interest at maturity: AI = P AR × -R--M × A--E where: AI =accrued interest PAR =par value (principal amount to be paid at maturity) Depreciation RDV = CST N SAL N accumulated depreciation Values for DEP, RDV, CST, and SAL are rounded to the number of decimals you choose to be displayed. In the following formulas, FSTYR = (13 N MO1) P 12. 88 Appendix - Reference Information