HP HP12C hp 12c_user's guide_English_E_HDPMBF12E44.pdf - Page 50

HP HP12C - 12c Financial Calculator Manual

|

UPC - 882780792104

View all HP HP12C manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 50 highlights

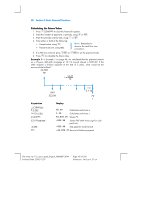

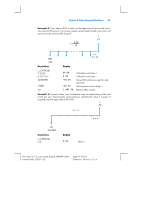

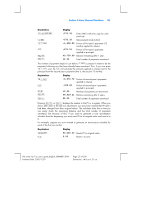

50 Section 3: Basic Financial Functions Keystrokes 2Þ¼ 32000Þ $ M Display -2.00 Stores i (with minus sign for a "negative interest rate"). -32,000.00 Stores PV (with minus sign for cash paid out). 28,346.96 Property value after 6 years. Odd-Period Calculations The cash flow diagrams and examples presented so far have dealt with financial transactions in which interest begins to accrue at the beginning of the first regular payment period. However, interest often begins to accrue prior to the beginning of the first regular payment period. The period from the date interest begins accruing to the date of the first payment, being not equal to the regular payment periods is sometimes referred to as an "odd first period". For simplicity, in using the hp 12c we will always regard the first period as equal to the remaining periods, and we will refer to the period between the date interest begins accruing and the beginning of the first payment period as simply the "odd period" or the "odd days". (Note that the odd period is always assumed by the calculator to occur before the first full payment period.) The following two cash flow diagrams represent transactions including an odd period for payments in advance (Begin) and for payments in arrears (End). File name: hp 12c_user's guide_English_HDPMBF12E44 Printered Date: 2005/7/29 Page: 50 of 209 Dimension: 14.8 cm x 21 cm