HP HP12C hp 12c_user's guide_English_E_HDPMBF12E44.pdf - Page 58

Calculating NPV for Ungrouped Cash Flows.

|

UPC - 882780792104

View all HP HP12C manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 58 highlights

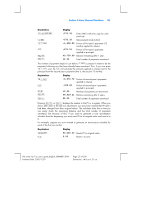

58 Section 4: Additional Financial Functions z If NPV is positive, the financial value of the investor's assets would be increased: the investment is financially attractive. z If NPV is zero, the financial value of the investor's assets would not change: the investor is indifferent toward the investment. z If NPV is negative, the financial value of the investor's assets would be decreased: the investment is not financially attractive. A comparison of the NPV's of alternative investment possibilities indicates which of them is most desirable: the greater the NPV, the greater the increase in the financial value of the investor's assets. IRR is the rate of return at which the discounted future cash flows equal the initial cash outlay: IRR is the discount rate at which NPV is zero. The value of IRR relative to the present value discount rate also indicates the result of the investment: z If IRR is greater than the desired rate of return, the investment is financially attractive. z If IRR is equal to the desired rate of return, the investor is indifferent toward the investment. z If IRR is less than the desired rate of return, the investment is not financially attractive. Calculating Net Present Value (NPV) Calculating NPV for Ungrouped Cash Flows. If there are no equal consecutive cash flows, use the procedure described (and then summarized) below. With this procedure, NPV (and IRR) problems involving up to 20 cash flows (in addition to the initial investment CF0) can be solved. If two or more consecutive cash flows are equal - for example, if the cash flows in periods three and four are both $8,500 - you can solve problems involving more than 20 cash flows, or you can minimize the number of storage registers required for problems involving less than 20 cash flows, by using the procedure described next (under Calculating NPV for Grouped Cash Flows, page 61). The amount of the initial investment (CF0) is entered into the calculator using the J key. Pressing gJ stores CF0 in storage register R0 and also stores the number 0 in the n register. File name: hp 12c_user's guide_English_HDPMBF12E44 Printered Date: 2005/7/29 Page: 58 of 209 Dimension: 14.8 cm x 21 cm