HP HP12C hp 12c_user's guide_English_E_HDPMBF12E44.pdf - Page 60

HP HP12C - 12c Financial Calculator Manual

|

UPC - 882780792104

View all HP HP12C manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 60 highlights

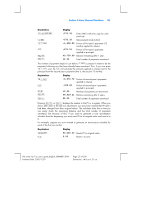

60 Section 4: Additional Financial Functions Example: An investor has an opportunity to buy a duplex for $80,000 and would like a return of at least 13%. He expects to keep the duplex 5 years and then sell it for $130,000; and he anticipates the cash flows shown in the diagram below. Calculate NPV to determine whether the investment would result in a return or a loss. Note that although a cash flow amount ($4,500) occurs twice, these cash flows are not consecutive. Therefore, these cash flows must be entered using the method described above. Keystrokes fCLEARH 80000ÞgJ 500ÞgK 4500gK 5500gK 4500gK 130000gK :n 13¼ fl Display 0.00 Clears financial and storage registers. -80,000.00 Stores CF0 (with minus sign for a negative cash flow). -500.00 Stores CF1 (with minus sign for a negative cash flow). 4,500.00 Stores CF2. 5,500.00 Stores CF3. 4,500.00 Stores CF4. 130,000.00 Stores CF5. 5.00 13.00 Checks number of cash flow amounts entered (in addition to CF0 ). Stores i. 212.18 NPV. Since NPV is positive, the investment would increase the financial value of the investor's assets. File name: hp 12c_user's guide_English_HDPMBF12E44 Printered Date: 2005/7/29 Page: 60 of 209 Dimension: 14.8 cm x 21 cm