Casio FX-9750GII-SC User Guide - Page 246

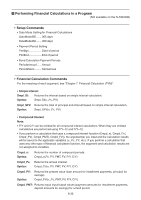

Performing Financial Calculations in a Program, Simple Interest, Smpl_SI, Syntax, Compound Interest

|

UPC - 079767186067

View all Casio FX-9750GII-SC manuals

Add to My Manuals

Save this manual to your list of manuals |

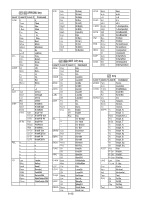

Page 246 highlights

I Performing Financial Calculations in a Program (Not available on the fx-7400GII) • Setup Commands • Date Mode Setting for Financial Calculations DateMode365....... 365 days DateMode360....... 360 days • Payment Period Setting PmtBgn Start of period PmtEnd End of period • Bond Calculation Payment Periods PeriodsAnnual ...... Annual PeriodsSemi ......... Semiannual • Financial Calculation Commands For the meaning of each argument, see "Chapter 7 Financial Calculation (TVM)". • Simple Interest Smpl_SI: Returns the interest based on simple interest calculation. Syntax: Smpl_SI(n, I%, PV) Smpl_SFV: Returns the total of principal and interest based on simple interest calculation. Syntax: Smpl_SFV(n, I%, PV) • Compound Interest Note: • P/Y and C/Y can be omitted for all compound interest calculations. When they are omitted, calculations are performed using P/Y=12 and C/Y=12. • If you perform a calculation that uses a compound interest function (Cmpd_n(, Cmpd_I%(, Cmpd_PV(, Cmpd_PMT(, Cmpd_FV(), the argument(s) you input and the calculation results will be saved to the applicable variables (n, I%, PV, etc.). If you perform a calculation that uses any other type of financial calculation function, the argument and calculation results are not assigned to variables. Cmpd_n: Syntax: Returns the number of compound periods. Cmpd_n(I%, PV, PMT, FV, P/Y, C/Y) Cmpd_I%: Returns the annual interest. Syntax: Cmpd_I%(n, PV, PMT, FV, P/Y, C/Y) Cmpd_PV: Syntax: Returns the present value (loan amount for installment payments, principal for savings). Cmpd_PV(n, I%, PMT, FV, P/Y, C/Y) Cmpd_PMT: Returns equal input/output values (payment amounts for installment payments, deposit amounts for savings) for a fixed period. 8-35