HP 30b HP 20b Business Consultant and HP 30b Business Professional User's Guid - Page 39

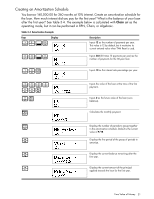

Creating an Amortization Schedule

|

View all HP 30b manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 39 highlights

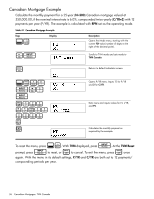

Creating an Amortization Schedule You borrow 140,000.00 for 360 months at 10% interest. Create an amortization schedule for the loan. How much interest did you pay for the first year? What is the balance of your loan after the first year? See Table 3-4. The example below is calculated with Chain set as the operating mode, but it can be performed in RPN, Chain, or Algebraic. Table 3-4 Amortization Example Keys Display 12:[ Description Inputs 12 as the number of payments per year. This value is 12 by default, but it maintains its current entered value when TVM Reset is used. 30:^ Inputs 360 (30 times 12 payments per year) as the number of payments for the 30-year loan. 10Y Inputs 10 as the interest rate percentage per year. 1400 00V 0F M Inputs the value of the loan at the time of the first payment. Inputs 0 as the future value of the loan (zero balance). Calculates the monthly payment. A < < < Displays the number of periods to group together in the amortization schedule. Default is the current value of P/YR. Displays the first period of the group of periods to amortize. Displays the current balance remaining after the first year. Displays the current amount of the principal applied towards the loan for the first year. Time Value of Money 31