HP 30b HP 20b Business Consultant and HP 30b Business Professional User's Guid - Page 52

Editing Cash Flows

|

View all HP 30b manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 52 highlights

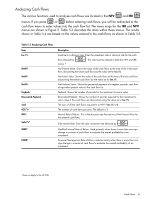

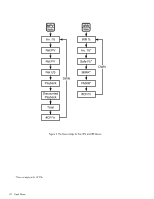

Editing Cash Flows In the cash flow list, you can view and modify the current monetary value of a specific cash < > flow, or cash flows. Press or repeatedly to scroll through the list. To modify the I displayed entry, type a new number and press . For example, to change the current monetary value of the cash flow three, CF(3), in the example in Table 5-2 from 0 to 200, with 200 I CF(3)= displayed, press followed by . You can also modify the number of occurrences of a cash flow in the same manner with #CF(n) :j displayed. Pressing with a cash flow displayed erases the displayed cash flow. :o Pressing inserts a cash flow into the list before the displayed cash flow. Note that the values for the number of cash flows occurring for a given year, (#CF/Yr) Investment interest rate, (Inv. I%), and safe interest rate (Safe I%) can be entered in both the I NPV and IRR menus*. Key in the desired number or rate followed by with the item displayed. The other items are then calculated internally. Modified Internal Rate of Return (MIRR) and Financial Management Rate of Return (FMRR)* For the cash flow example you entered in Table 5-2, edit the cash flows using the cash flow amounts and number of occurrences shown in Table 5-5 below. For the initial cash flow, CF(0), enter -1,250,000. In the IRR menu, enter 8% for investment interest rate, and 5% as a safe rate. Verify the number of cash flows per year, #CF/Yr, is set to 1. The results for MIRR and FMRR are shown in Table 5-6. This example was calculated in Algebraic mode. Cash Flow Number 1 2 3 4 5 6 7 Table 5-5 Cash Flow Amount -300,000.00 200,000.00 450,000.00 -200,000.00 700,000.00 300,000.00 500,000.00 Occurrences 1 1 1 1 1 1 1 *Does not apply to the HP 20b. 44 Cash Flows