HP 30b HP 20b Business Consultant and HP 30b Business Professional User's Guid - Page 57

Bond Calculation Example

|

View all HP 30b manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 57 highlights

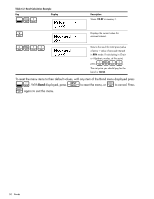

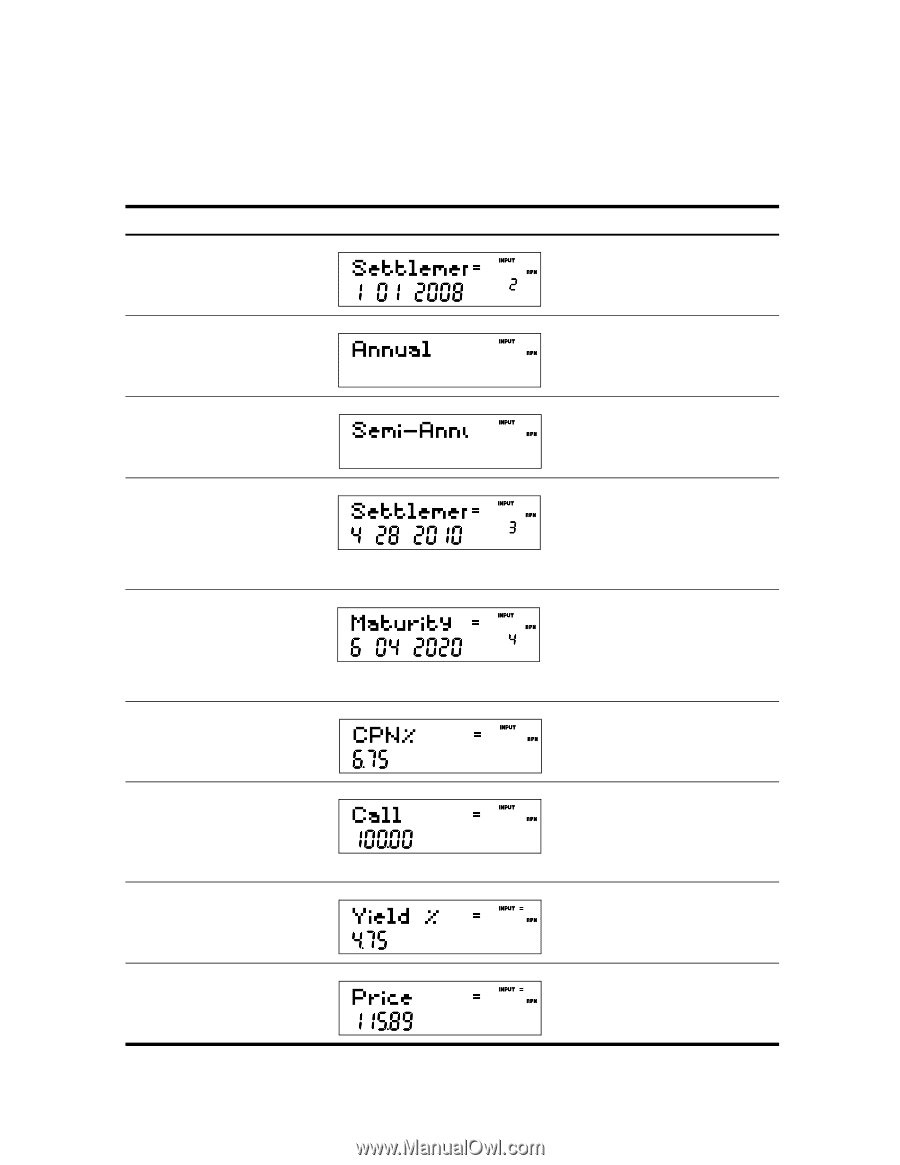

Bond Calculation Example What price should you pay on April 28, 2010 for a 6.75% U.S. Treasury bond maturing on June 4, 2020, if you want a yield of 4.75%? Assume the bond is calculated on a semiannual coupon payment on an actual/actual basis. See Table 6-2. The example below is calculated with RPN as the active operating mode. Table 6-2 Bond Calculation Example Key B Display Description Opens the Bond menu. > I

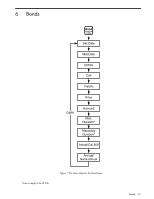

Bonds

49

Bond Calculation Example

What price should you pay on April 28, 2010 for a 6.75% U.S. Treasury bond maturing on June 4,

2020, if you want a yield of 4.75%? Assume the bond is calculated on a semiannual coupon payment

on an actual/actual basis. See Table 6-2. The example below is calculated with RPN as the active

operating mode.

Table 6-2

Bond Calculation Example

Key

Display

Description

B

Opens the Bond menu.

>

Scrolls to bond coupon (payment)

frequency.

I

Selects semiannual coupon payment,

as required by the example.

<4.2

82010

I

Inputs April 28, 2010 for the

settlement date (

mm.ddyyyy

format).

<6.0

42020

I

Inputs

June 4, 2020

for the maturity

date.

<6.7

5I

Inputs

6.75%

for the value for

CPN%

.

<

Displays current call value. Default is

100

. Note: if

Call

requires another

value, key in the number followed by

I

.

<4.7

5I

Inputs

4.75%

for

Yield%

.

<=

Calculates the current value for

Price

.