HP 30b HP 20b Business Consultant and HP 30b Business Professional User's Guid - Page 76

displayed press, To reset the menu items to their default values

|

View all HP 30b manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 76 highlights

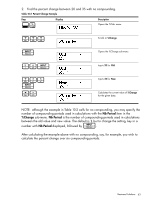

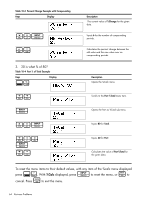

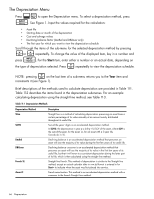

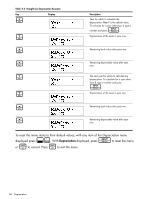

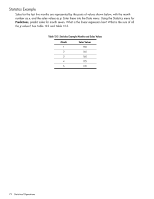

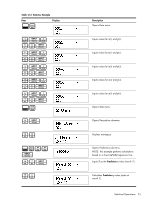

Table 11-3 Straight Line Depreciation Example Key < Display < < < < < < < Description Year for which to calculate the depreciation. Year 1 is the default value. To calculate for a year other than 1, type a I number and press . Depreciation of the asset in year one. Remaining book value after year one. Remaining depreciable value after year one. The next year for which to calculate the depreciation. To calculate for a year other than 2, type a number and press I. Depreciation of the asset in year two. Remaining book value after year two. Remaining depreciable value after year two. To reset the menu items to their default values, with any item of the Depreciation menu :x I displayed press . With Depreciation displayed, press to reset the menu, O O or to cancel. Press to exit the menu. 68 Depreciation