Texas Instruments TINSPIRE Reference Guide - Page 76

Matrix1, InterestRate, CFList, CFFreq, Equation, Guess, number or error_string, lowBound, upBound - help

|

View all Texas Instruments TINSPIRE manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 76 highlights

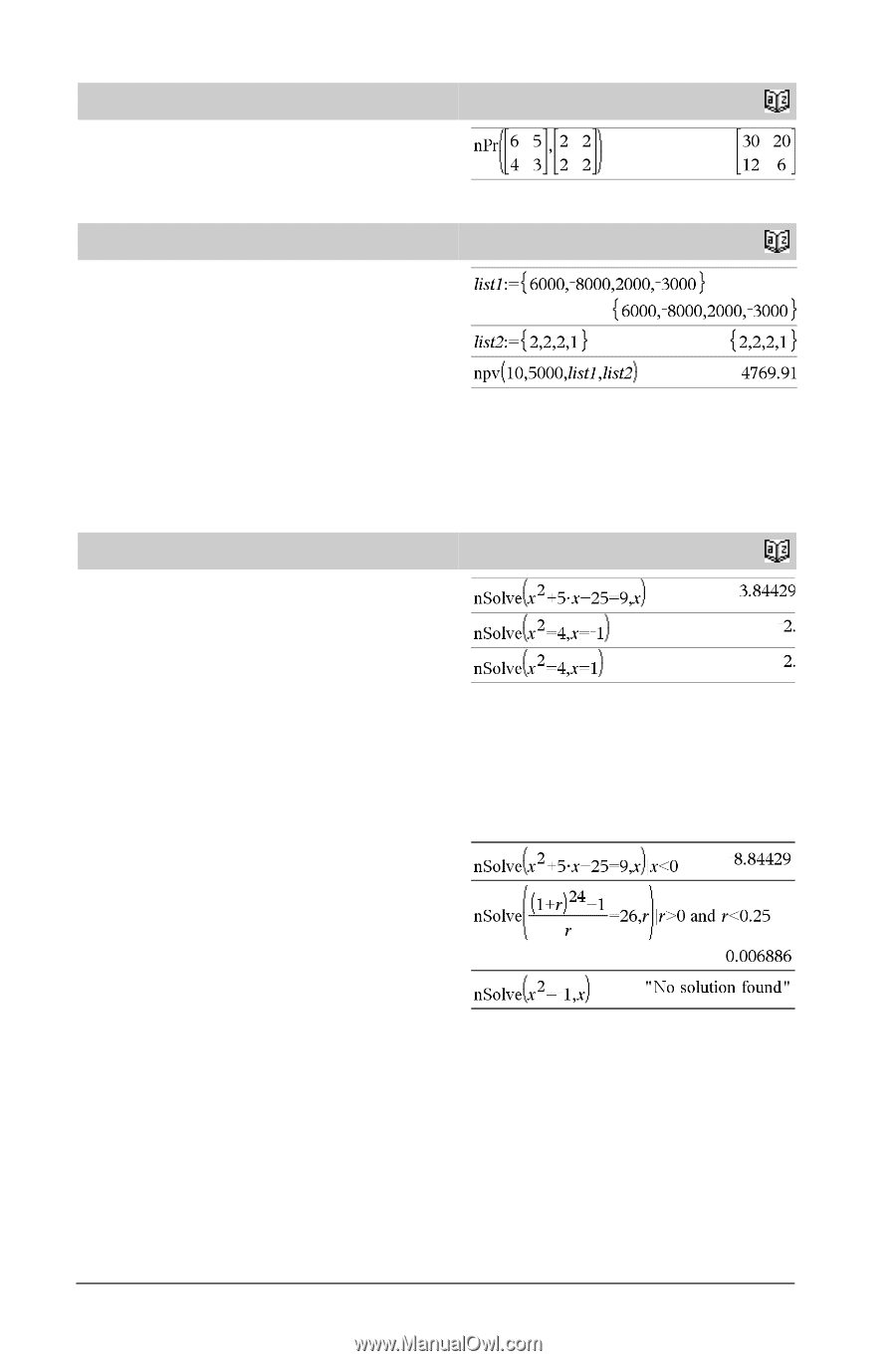

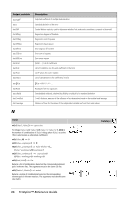

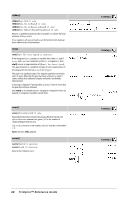

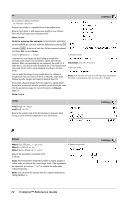

nPr( ) nPr(Matrix1, Matrix2) ⇒ matrix Returns a matrix of permutations based on the corresponding element pairs in the two matrices. The arguments must be the same size matrix. Catalog > npv( ) npv(InterestRate,CFO,CFList[,CFFreq]) Financial function that calculates net present value; the sum of the present values for the cash inflows and outflows. A positive result for npv indicates a profitable investment. InterestRate is the rate by which to discount the cash flows (the cost of money) over one period. CF0 is the initial cash flow at time 0; it must be a real number. CFList is a list of cash flow amounts after the initial cash flow CF0. CFFreq is a list in which each element specifies the frequency of occurrence for a grouped (consecutive) cash flow amount, which is the corresponding element of CFList. The default is 1; if you enter values, they must be positive integers < 10,000. Catalog > nSolve( ) Catalog > nSolve(Equation,Var[=Guess]) ⇒ number or error_string nSolve(Equation,Var[=Guess],lowBound) ⇒ number or error_string nSolve(Equation,Var[=Guess],lowBound,upBound) ⇒ number or error_string nSolve(Equation,Var[=Guess]) | lowBound