Sharp UP-820N UP-820N Operation Manual - Page 237

Tax Programming

|

View all Sharp UP-820N manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 237 highlights

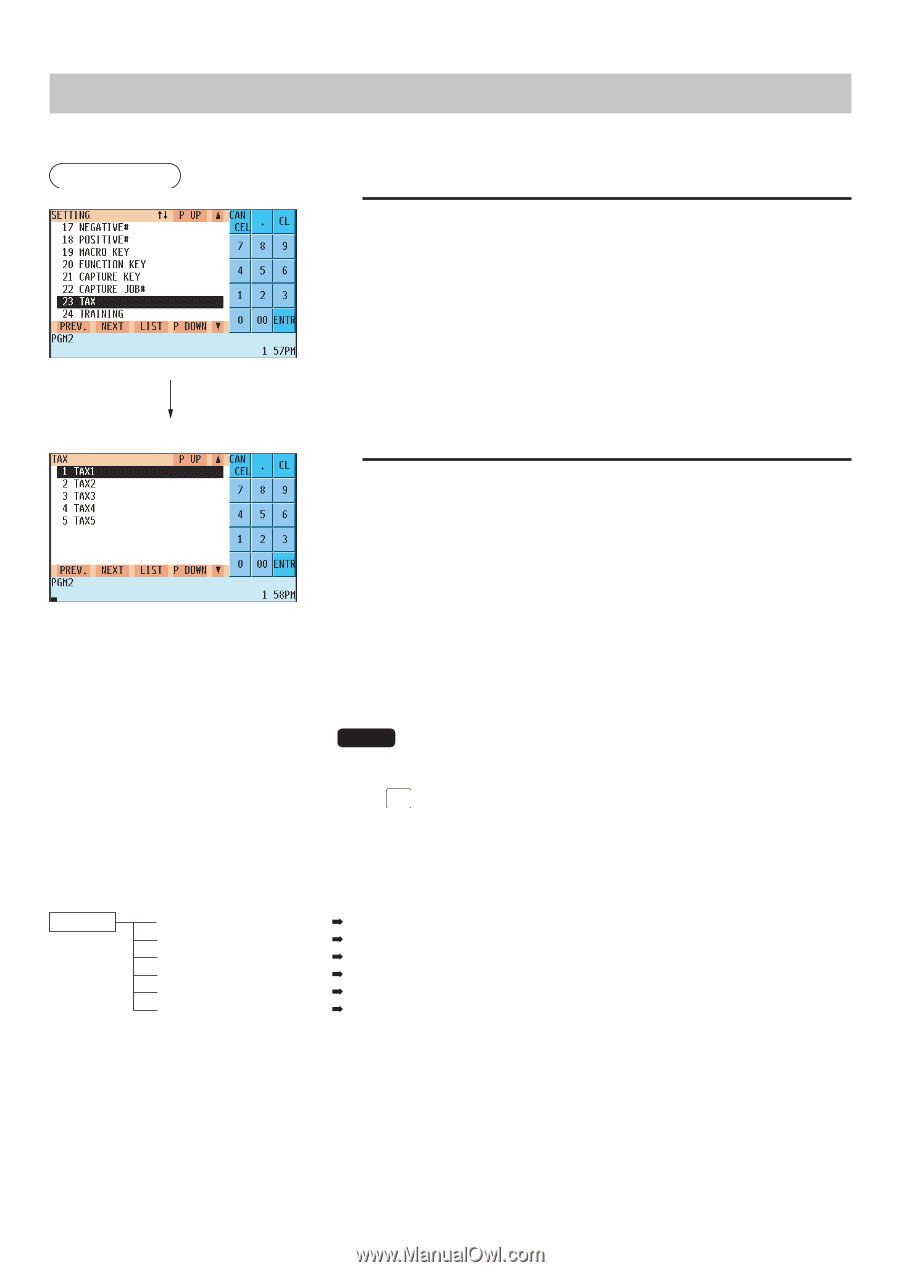

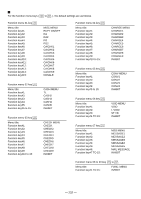

Tax Programming Use the following procedure for tax programming: Procedure 1. In the SETTING window, select "23 TAX." • The TAX window will appear. 2. Select any option from the following options list: 1 TAX1: Tax1 2 TAX2: Tax2 3 TAX3: Tax3 4 TAX4: Tax4 5 TAX5: Tax5 6 DOUGHNUT EXPT: Doughnut exemption (for the Canadian tax system) NOTE • The option "6 DOUGHNUT EXPT" appears only when the Canadian tax system is selected. • If the (DEL) key is pressed on the tax number selection menu, the tax table or the tax in the cursor position will be deleted. The following illustration shows the tax programming options. 23 TAX 1 TAX1 2 TAX2 3 TAX3 4 TAX4 5 TAX5 6 DOUGHNUT EXPT See "Table tax" on page 236 or "Rate (%) tax" on page 238. See "Table tax" on page 236 or "Rate (%) tax" on page 238. See "Table tax" on page 236 or "Rate (%) tax" on page 238. See "Table tax" on page 236 or "Rate (%) tax" on page 238. See "Table tax" on page 236 or "Rate (%) tax" on page 238. See "Doughnut tax exemption" on page 238. - 235 -