HP 12C#ABA hp 12c_solutions handbook_English_E.pdf

HP 12C#ABA - 12C Financial Calculator Manual

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

HP 12C#ABA manual content summary:

- HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 1

- HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 2

supplement the HP-12C Owner's Handbook by providing a variety of applications in the financial area. Programs and/or step-by-step keystroke procedures with corresponding examples in each specific topic are explained. We hope that this book will serve as a reference guide to many of your problems and - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 3

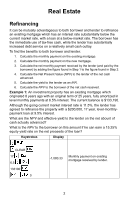

lender of the net cash advanced. 5. Calculate the yield to the lender as an IRR. 6. Calculate the NPV to the borrower of the net cash received. Example 1: An investment property has an existing mortgage which originated 8 years ago with an original term of 25 years, fully amortized in level monthly - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 4

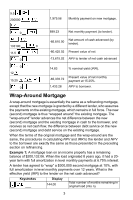

, and receives as net cash flow, the difference between debt service on the new (second) mortgage and debt service on the existing mortgage. When the terms of the original mortgage and the wrap-around are the same, the procedures in calculating NPV and IRR to the lender and NPV to the borrower are - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 5

. Amount of wrap-around (into PV). Monthly payment on wrap-around (calculated). Net monthly payment received (into PMT). -99,867.94 Net cash advanced (into PV). 200132.06 12 15.85 Nominal yield (IRR) to lender (calculated). Sometimes the wrap around mortgage will have a longer payback period - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 6

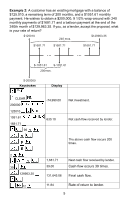

Keystrokes Display CLEAR 200000 125010 1051.61 1681.71 99 2 39 129963.35 12 -74,990.00 Net investment. 630.10 Net cash flow received by lender. The above cash flow occurs 200 times. 1,681.71 39.00 Next cash flow received by lender. Cash flow occurs 39 times. 131,645.06 Final cash flow. 11 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 7

payment amount necessary to achieve the desired yield. 10. Key in the amount of the wrap-around mortgage and press to obtain the borrower's periodic Display CLEAR 200 12 1051.61 74990 Number of periods and monthly interest rate. -165,776.92 Present value of payments plus cash advanced - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 8

Cash) The derivation of these cash flows follows a set sequence: 1. Calculate Potential Gross Income by multiplying the rent per unit times the number of units, times the number of rental payments periods . 5. Deduct Annual Debt Service on the mortgage. This produces Cash ThrowOff to Equity. Thus - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 9

Keystrokes Display CLEAR 60 180,000.00 Potential Gross Income. 250 12 5 9,000.00 171,000.00 Vacancy Loss. Effective Gross Income. 76855 94,145.00 Net Operating Income. 20 11.5 700000 -89,580.09 Annual Debt Service. 12 4,564.91 Cash Throw-Off. Before-Tax Reversions (Resale Proceeds) - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 10

Tax Liability = Taxable Income x Marginal Tax Rate. After Tax Cash Flow = Cash Throw Off - Tax Liability. The After-Tax Cash Flow for the initial and successive years may be calculated by the following HP-12C program. This program calculates the Net Operating Income using the Potential Gross Income - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 11

KEYSTROKES DISPLAY CLEAR 0 1 7 2 7 1 1 1 2 0 5 6 6 4 00- 01- 0 02- 11 03- 44 1 04- 45 7 05- 26 06- 2 07- 10 08- 44 7 09- 1 10-44 40 1 11- 1 12- 2 13- 42 11 14- - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 12

4 36 1 0 0 17 2 8 2 0 3 9 3 1 7 0 27- 44 4 28- 33 29- 43 35 30-43, 33 36 31- 45 1 32- 42 25 33-44 30 0 34- 0 35-43, 33 17 36- 11 37- 45 2 38- 45 8 39- 25 40-44 40 2 41- 33 42-45 48 0 43- 25 44- 30 45- 45 3 46- 45 9 47- 25 48-44 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 13

: Used FV: 0 R1: Counter R3: Oper. cost R5: Dep. life R7: Tax Rate R9: % gr. (op) REGISTERS i: Annual % PMT: Monthly R0: Used R2: PGI R4: Dep. value R6: Factor (DB) R8: % gr. (PGI) R.0: Vacancy rt. 1. Press and press CLEAR . 2. Key in loan values: • Key in annual interest rate and press • Key - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 14

useful life of $20 years. Assuming a 125% declining balance depreciation, what are the After-Tax Cash Flows for the first 10 years if the investors Marginal Tax Rate is 35%? Keystrokes Display CLEAR 100000 20 12.25 30 9900 2 3291.75 3 75000 4 20 5 80,000.00 Mortgage amount. 1.02 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 15

35 year economic life. Straight line depreciation will be used. The property is financed with a $1,050,000 loan. The terms of the loan are 9.5% interest what are the After- Tax Cash Flows for the first 5 years? Keystrokes Display CLEAR 1050000 9173.81 9.5 175,200.00 Potential Gross Income. 14 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 16

to equity; generally, the estimated resale price of the property less commissions, outstanding debt and any tax claim. The After-Tax Net Cash Proceeds can be found using the HP-12C program which follows. In calculating the owner's income tax liability on resale, this program assumes that the owner - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 17

The user may change to a different depreciation method by keying in the desired function at line 35 in place of . KEYSTROKES DISPLAY CLEAR 2 4 1 2 0 CLEAR 3 4 5 00- 01- 43 8 02- 44 2 03- 33 04- 25 05- 30 06- 44 0 07- 30 08- 48 09- 4 10- 20 11- 44 1 12- 45 14 13- 42 14 14- - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 18

: Used FV: Used R1: Used 25- 12 26- 45 2 27- 42 23 28- 45 2 29- 20 30- 48 31- 6 32- 20 33-44 40 1 34- 45 2 35- 42 25 36- 34 37- 45 13 38- 30 39-44 40 1 40- 45 6 41- 26 42- 2 43- 10 44- 45 1 45- 20 46- 45 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 19

,000 loan for 20 years at 9.5% annual interest was used to purchase the complex. When it was purchased the depreciable value was $750,000 with a useful life of 25 years. Using 125% declining balance depreciation, what are the After-Tax Net Cash Proceeds in year 10? Keystrokes Display 0.00 CLEAR - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 20

10 700,000.00 Mortgage. 0.79 Monthly interest. 240.00 Number of payments. -6,524.92 Monthly payment. 750,000.00 Depreciable value. 25.00 Depreciable life. 125.00 Factor. 48.00 Marginal Tax Rate. 900,000.00 Purchase price. 1,750,000.00 Sale price. 8.00 Commission rate. 911,372.04 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 21

remaining balance after each successive payment may be calculated as follows: 1. Key in the constant periodic payment to principal and press 0. 2. Key in periodic interest rate and press . 3. Key in the loan amount. If you wish to skip to another time period, press . Then key in the number of - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 22

of months are known. 1. Press and press CLEAR . 2. Key in the number of months in loan and press . 3. Key in the add-on rate and press . 4. Key in the amount of the loan and press received; negative for cash paid out.) 5. Press . * (*Positive for cash . 6. Press 12 to obtain the APR. 21 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 23

Example 1: Calculate the APR and monthly payment of a 12% $1000 add-on loan which has a life of 18 months. Keystrokes Display CLEAR 18 12 1000 12 1,180.00 -65.56 21.64 Amount of loan. Monthly payment. Annual Percentage Rate. APR Converted to Add-On Interest Rate. Given the number of months and - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 24

On Rate Loan with Credit Life. This HP-12C program calculates the monthly payment amount, credit life amount (an optional occur. KEYSTROKES DISPLAY CLEAR 1 0 1 2 0 0 4 2 1 4 4 1 00- 01- 43 8 02- 1 03- 45 0 04- 1 05- 2 06- 0 07- 0 08- 10 09- 44 4 10- 45 2 11- 20 12- 30 13- 43 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 25

1 3 0 0 2 0 1 2 5 2 22- 1 23- 40 24- 34 25- 10 26- 45 3 27- 20 28- 45 0 29- 10 30- 42 14 31- 16 32- 14 33- 31 34- 45 14 35- 45 0 36- 20 37- 16 38- 13 39- 45 13 40- 45 2 41- 25 42- 45 0 43- 20 44- 1 45- 2 46- 10 47- 44 5 48- 26 49- 2 50- 20 24 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 26

54- 45 5 55- 48 56- 0 57- 1 58- 40 59- 42 14 60- 44 5 61- 45 5 62- 31 63- 45 13 64- 34 65- 30 66- 45 3 67- 30 68- 16 69- 31 70- 45 5 71- 45 3 72- 40 73- 13 74- 45 0 75- 11 76- 12 77-45, 43 12 78-43 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 27

CL (%) R4: N/1200 R6-R9: Unused 2. Press CLEAR . 3. Key in the number of monthly payments in the loan and press 0. 4. Key in the annual add-on interest rate as a percentage and press 1. 5. Key in the credit life as a percentage and press 2. 6. Key in the loan amount and press 3. 7. Press - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 28

39.33 per month. What is the rebate and balance due after the 25th regular payment? Keystrokes Display 30 1 25 2 1 180 1 5.81 Rebate. 1 2 39.33 2 190.84 Outstanding principal. The following HP-12C program can be used to evaluate the previous example. KEYSTROKES DISPLAY CLEAR 0027 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 29

03- 44 2 04- 33 05- 44 1 06- 45 2 07- 30 08- 44 2 09- 1 10- 40 11- 45 0 12- 20 13- 45 1 14- 36 15- 20 16- 45 1 17- 40 18- 10 19- 45 2 20- 20 21- 31 22- 45 2 23- 20 24- 34 25- 30 26-43, 33 00 REGISTERS i: Unused 28 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 30

periodic payment amount and press principal outstanding. 6. For a new case return to step 2. Keystrokes Display to find the amount of 30 25 the loan amount, the percentage that the payments increase, and the number of years that the payments increase, the following HP-12C program determines - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 31

KEYSTROKES DISPLAY CLEAR 2 1 1 0 2 3 1 1 0 00010203040506070809101112131415161718192021222324252627- 30 43 8 44 2 34 1 25 1 40 44 0 45 11 45 2 30 43 11 45 12 43 12 45 13 44 3 1 16 14 13 16 15 1 43 11 45 14 45 0 10 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 32

31- 15 32- 1 33- 1 34-44 40 1 35- 45 2 36- 30 37- 43 35 38-43, 33 40 39-43, 33 25 40- 45 3 41- 45 13 42- 10 43- 44 4 44- 45 3 45- 13 46- 1 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 33

- 42 14 59- 14 60- 31 61- 15 62- 15 63- 42 14 64- 31 65- 16 66- 13 67- 1 68-44 40 3 69-44 30 1 70- 45 1 71- 43 35 72-43, 33 74 73-43, 33 48 74- 45 4 75- 16 76- 31 77-43, 33 76 REGISTERS i: i/12 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 34

will be level for the remaining 25 years. What are the monthly payment amount for the first 6 years? Keystrokes Display CLEAR 0.00 30 30.00 Term 12.5 12.50 Annual interest rate 50000 50,000.00 Loan amount 5 5.00 Rate of graduation 5 1.00 Year 1 -448.88 1st year monthly payment - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 35

the term of the mortgage. The period and limits to interest rate increases vary from state to state. Each periodic adjustment may be calculated by using the HP-12C with the following keystroke procedure. The original terms of the mortgage are assumed to be known. 1. Press and press CLEAR . 34 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 36

what will the monthly payment be? If the monthly payment remained unchanged, find the revised remaining term on the mortgage. Keystrokes Display CLEAR 50000 11.5 3 495.15 50,000.00 Original amount of loan. 0.96 36.00 -495.15 Original monthly interest rate. Period. Previous monthly payment. 35 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 37

which a payment is not made. To find the monthly payment amount necessary to amortize the loan in the specified amount of time, information is entered as follows: 1. Press and press CLEAR . 2. Key in the number of the last payment period before payments close the first time and press . 3. Key - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 38

amount when the payment is made at the beginning of the month. Example: A bulldozer worth $100,000 is being purchased in September. The first payment is due one month later, and payments will continue over a period payment necessary to amortize the loan? Keystrokes Display CLEAR 3 14 1 12 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 39

periodic deposits coincident with the compounding period, the future value (or accumulated amount) may be calculated as follows: 1. Press and press CLEAR Display CLEAR 200 2,178.94 Value of the account. 3 5.25 50 Note: If the periodic deposits do not coincide with the compounding periods, - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 40

Display CLEAR 18000 5.25 300 5000 71.00 Months to deplete account. 53.00 Months to reduce the account to $5,000 Periodic Deposits and Withdrawals This section is presented as a guideline for evaluating a savings plan when deposits and withdrawals occur at irregular intervals. One problem - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 41

The cash flow diagram looks like this: FV = ? 1 2 3 4 5 -50 -50 -50 -50 -50 PV = - 1023.25 Keystrokes Display CLEAR 50 1,299.22 Amount in account. 5.5 1023.25 5 Now suppose that at the beginning of the 6th month you withdrew $80. What is the new balance? Keystrokes Display 80 1, - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 42

account? FV = ? 1 2 PV = -1431.95 Keystrokes Display 2 0 1,455.11 Account balance. This type of procedure may be continued for any length of time, and may be modified to meet the user's particular needs. Savings Account Compounded Daily This HP 12C program determines the value of a savings - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 43

calculate the total amount remaining in the account after a series of transactions on specified dates. KEYSTROKES DISPLAY CLEAR 3 6 5 0 2 1 0 1 00- 01- 16 02- 13 03- 33 04- 3 05- 6 06- 5 07- 10 08- 12 09- 33 10- 44 0 11- 15 13 12- 16 13- 31 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 44

3 28- 45 15 29- 45 2 30- 40 31- 16 32- 13 33- 45 1 34- 44 0 35- 45 13 36- 16 37-43, 33 13 n: ∆days PV: Used FV: Used R1: Next date R3: Interest 1. Key in the program 2. Press CLEAR REGISTERS i: i/365 PMT: 0 R0: Initial date R2: $ amount R4-R.4: Unused and press . 3. Key - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 45

amount .00 Keystrokes Display CLEAR 1.191981 5. Periods Different From Payment Periods In financial calculations involving a series of payments equally spaced in time with periodic compounding, both periods of time are normally equal and coincident. This assumption is preprogrammed into the HP 12C - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 46

compounding frequencies offered. The HP 12C can easily be used in these calculations. However, because of the assumptions mentioned the periodic interest rate must be much will you receive from the account? Keystrokes Display CLEAR 5 365 100 12 CLEAR 0.42 Equivalent periodic interest rate. 45 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 47

deposits in a savings account paying 5.5% compounded quarterly. What amount must you deposit each week to accumulate $6000. Keystrokes Display CLEAR 5.5 4 0.11 Equivalent periodic interest rate. 100 52 CLEAR 8 52 6000 -11.49 Periodic payment. Example 3: Solving for number of payment - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 48

advantage of treating the lease payment as an expense. The resulting cash flows are discounted to the present at the firm's after-tax cost of capital. KEYSTROKES DISPLAY CLEAR 1 0 3 8 1 1 9 00- 01- 30 02- 1 03-44 40 0 04- 45 3 05- 30 06- 20 07- 44 8 08- 1 09- 42 11 10- 44 1 11 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 49

48 2 19- 45 5 20- 13 21- 45 6 22- 11 23- 45 7 24- 12 25- 45 0 26- 42 24 27-44 40 1 28- 45 9 29- 13 30-45 48 0 31- 14 32-45 48 1 33- 11 34-45 48 2 35- 12 36- 45 1 37- 45 3 38- 20 39- 45 14 40 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 50

R6: Dep. life R8: Used R.0: Used R.2: Used Instructions: 1. Key in the program. -Select the depreciation function and key in at line 26. 2. Press and press CLEAR . 3. Input the following information for the purchase of the loan: -Key in the number of years for amortization and press . -Key - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 51

company would use sum of the years digits depreciation on a 10 year life with $1500 salvage value. An accountant informs management to take the 10% capital investment tax credit at the end of the second year and to figure the cash flows at a 48% tax rate. The after tax cost of capital (discounting - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 52

1700 1700 1700 0 0 Display 0.00 1000 750 -10,000.00 1,769.84 0.48 1.05 Always use negative loan amount. Purchase payment. Marginal tax rate. Discounting factor. 8,500.00 10.00 3,400.00 2 1,768.00 312.36 200.43 1,000.00 907.03 95.05 Depreciable value. Depreciable life. 1st lease payment. After - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 53

. After tax buy back expense. Present value. Net lease advantage. Break-Even Analysis Break-even analysis is basically a technique for analyzing the relationships among fixed costs, variable costs, and income. Until the break even point is reached at the intersection of the total income and total - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 54

Costs Variable Costs Break-Even Point Fixed Costs The variables are: fixed costs (F), Sales price per unit (P), variable cost per unit (V), number of units sold (U), and gross profit (GP). One can readily evaluate GP, U or P given the four other variables. To calculate the break-even volume - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 55

in the variable cost per unit and press . 5. Press to calculate the sales volume. To calculate the required sales price to achieve a given gross profit at a specified many copies must be sold to break even? Keystrokes 12000 13 6.75 Display 12,000.00 13.00 1,920.00 Fixed cost. Sales price. Break - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 56

price per unit to achieve desired gross profit. For repeated calculation the following HP-12C program can be used. KEYSTROKES DISPLAY CLEAR 3 2 00 4 1 00 5 1 00 1 5 4 00- 01- 45 3 02- 45 2 03- 30 04-43, 33 00 05- 45 4 06- 20 07- 45 1 08- 30 09-43, 33 00 10- 45 5 11- 45 1 12- 40 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 57

) and press 3. d. Key in the sales volume, U, in units (if known) and press 4. e. Key in the gross profit, GP, (if known) and press 5. 2. To calculate the sales volume to achieve a desired gross profit: a. Store values as shown in 1a, 1b, and 1c. b. Key in the desired gross profit (zero for - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 58

volume is needed to break even? Keystrokes 35000 1 8.25 2 12.5 3 0 5 10 Display 35,000.00 8.25 12.50 0.00 8,235.29 Fixed cost. Variable cost. Sales price. the break even point, and they are relatively insensitive to changes in sales volume. The necessary inputs to calculate the degree of - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 59

per copy. Profit per copy. Operating further from the breakeven point and lesssensitive to changes in sales volume. For repeated calculations the following HP-12C program can be used: KEYSTROKES DISPLAY CLEAR 3 2 1 00 00- 01- 45 3 02- 45 2 03- 30 04- 20 05- 36 06- 36 07- 45 1 08 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 60

the Break-Even Analysis section, calculate the operating leverage at a HP-12C may be programmed to perform simplified profit and loss analysis using the standard profit income formula and can be used as a dynamic simulator to quickly simulate a company wide income statement by replacing list price - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 61

after tax (as a percentage) may be calculated if the other four are known. Since the tax rage varies from company to company, provision is made for inputting your applicable tax rate. The example problem uses a tax rate of 48%. KEYSTROKES DISPLAY CLEAR 5 6 4 0 0 00 3 1 2 0 1 00- 01- 45 5 02 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 62

26- 45 0 27- 20 28-43, 33 0 29- 10 30- 16 31- 45 1 32- 40 33- 45 1 34- 10 35- 45 0 36- 20 37-43, 33 00 38- 45 5 39- 45 6 40- 10 41- 30 42-43, 33 00 43- 45 5 44- 30 45- 45 6 46- 20 47-43, 33 00 REGISTERS i: Unused - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 63

tax CLEAR , then key in 100 and 2. Key in 1 and press , then key in your appropriate tax rate as a decimal and calculate list price: a. Do steps 2 and 3b, c, d, e above. b. Press 3 1 14 00. 5. To calculate discount: a. Do steps 2 and 3a, c, d, e above. b. Press 3 29 . 6. To calculate - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 64

a manufacturing cost of $2.50? The standard company operating expense is 32% of net shipping (sales) price and tax rate is 48%. Keystrokes Display CLEAR 100 0 100.00 1 .48 6 0.52 48% tax rate. 11.98 1 11.98 List price ($). 35 2 35.00 Discount (%). 2.50 3 2.50 Manufacturing cost - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 65

What reduction in manufacturing cost would achieve the same result without necessitating an increase in list price above $11.98? 13 7.79 01 2.30 Manufacturing cost ($). 64 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 66

HP-12C program calculate the after tax yield to maturity of a bond held for more than one year. The calculations KEYSTROKES DISPLAY CLEAR CLEAR 7 6 2 1 4 2 2 0 3 5 00- 01- 42 34 02- 44 7 03- 33 04- 44 6 05- 45 2 06- 45 1 07- 30 08- 45 4 09- 25 10- 45 2 11- 34 12- 30 13- - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 67

- 45 0 22- 10 23- 14 24- 45 1 25- 45 0 26- 10 27- 13 28- 45 6 29- 45 7 30- 42 22 31-43, 33 00 n: Unused PV: Used FV: 0 R1: Purchase price R3: Coupon rate R5: Income rate R7: Used 1. Key in the program. - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 68

have periodic coupons, since all interest is paid at maturity. A discounted note is a note that is purchase below its face value. The following HP 12C program finds the price and/or yield* (*The yield is a reflection of the return on an investment) of a discounted note. KEYSTROKES DISPLAY CLEAR - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 69

- 43 26 04- 45 3 05- 10 06- 45 5 07- 25 08- 1 09- 34 10- 30 11- 45 4 12- 20 13- 44 5 14- 31 15- 45 1 16- 45 2 17- 43 26 18- 45 3 19- 34 20- 10 21- 45 4 22- 45 5 23- 10 24- 1 25- 30 26- 20 27- 26 28- 2 29- 20 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 70

calculate the purchase price: a. Key in the discount rate and press 5. b. Press to calculate the purchase price. c. Press to calculate the yield. d. For a new case, go to step 3. 8. To calculate 15 to calculate the yield. c. For a new case, go to step 3. Example 1: Calculate the price - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 71

; settlement date June 25, 1980; maturity date September 10, 1980; price $99.45; redemption value $101.33. Assume 360 day basis. Keystrokes Display 6.251980 1 6.25 Settlement date. 9.101980 2 9.10 Maturity dtae. 360 3 360.00 360 day basis. 101.33 4 101.33 Redemption value per $100 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 72

the latest input. This replacement scheme makes the moving average a valuable tool in following trends. The fewer the number of data points, the more trend be calculated with your HP 12C as follows. 1. Press CLEAR . 2. Key in the first m data points (where m is the number of data points in the - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 73

for May. 190060 271120 2.00 3.00 234,460.00 3-month average for June. For repeated calculations the following HP 12C program can be used for up to a 12 element moving average: KEYSTROKES DISPLAY CLEAR 1 2 1 3 2 3 4 3 00- 01- 45 1 02- 45 2 03- 44 1 04- 40 05- 45 3 06- 44 2 07- 40 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 74

- 44 6 19- 40 20- 45 8 21- 44 7 22- 40 23- 45 9 24- 44 8 25- 40 26-45 48 0 27- 44 9 28- 40 29-45 48 1 30-44 48 0 31- 40 32-45 48 2 33-44 48 1 34- 40 35- 45 0 36- 10 73 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 75

the number of elements you desire. Key in this line, then skip the reset of the program down to line 35. Then key in lines 35 through program listing line 38, m becomes the displayed line 17, 5). To run the program: 1. Key in the program. 2. Press CLEAR . Key in the number of elements, m, - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 76

the next moving average. 8. Repeat step 7 for each new data point. Example 2: Calculate the 3-element moving average for the data given in example 1. Your modified program listing will look like this: KEYSTROKES DISPLAY CLEAR 1 2 1 3 2 3 0 3 01 00- 01- 45 1 02- 45 2 03- 44 1 04- 40 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 77

a centered 12 month moving averages. Programs for both of these calculations are represented here: An HP 12C program to calculate the quarterly seasonal variations based on a centered 4-point moving average is: KEYSTROKES DISPLAY CLEAR 1 2 2 1 3 00- 01- 45 1 02- 2 03- 10 04- 45 2 05- 44 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 78

: Unused FV: Unused R1: X1 R3: X3 R5: X5 1. Key in the program. REGISTERS i: Unused PMT: Unused R0: n R2: X2 R4: X4 R6-R.6: Unused 2. Press CLEAR . 3. Key in the quarterly sales figures starting with the first quarter: a. Key in 1st quarter sales and press 1. 77 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 79

and press average for the next quarter. to calculate the moving 7. Press to calculate the seasonal variation. 8. Repeat steps 6 and centered 4-quarter moving average and seasonal variation factor for each quarter. Keystrokes Display CLEAR 0.00 397 1 397.00 376 2 376.00 460 3 460.00 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 80

593 521.38 2nd quarter, 1980. 83.24 Now average each quarter's seasonal variation for the two years? Keystrokes Display CLEAR 0.00 98.86 1.00 99.95 2.00 99.41 1st quarter average seasonal variation, %. CLEAR 0.00 81.87 1.00 83.24 2.00 82.56 2nd quarter average seasonal variation - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 81

2.00 111.29 4th quarter average seasonal variation, %. An HP-12C program to calculate a centered 12-month moving average and seasonal variation factor is as follows: KEYSTROKES DISPLAY CLEAR 1 2 2 1 3 2 4 3 5 4 6 5 7 000102-2 0304050607080910111213141516171819- 45 1 10 45 2 44 1 40 45 3 44 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 82

6 8 7 9 8 0 9 1 0 2 1 3 2 2 0 6 20- 44 6 21- 40 22- 45 8 23- 44 7 24- 40 25- 45 9 26- 44 8 27- 40 28-45 48 0 29- 44 9 30- 40 31-45 48 1 32-44 48 0 33- 40 34-45 48 2 35-44 48 1 36- 40 37-45 48 3 38-44 48 2 39- 2 40- - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 83

X12 2. Press CLEAR . 3. Key in 12 and press 0. 4. Key in the values for the first 13 months, storing them one at a time calculate the moving average for the next month (8th). 8. Repeat steps 6 and 7 for the balance of the data. These programs may be customized by the user for different types - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 84

is small, then accelerates for a period of time and then slows again as HP 12C program processes the data, fits it to a Gompertz curve and calculates estimated values for future data points. The 3 constants which characterize the curve are available to the user if desired. KEYSTROKES DISPLAY CLEAR - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 85

4 6 1 3 2 1 3 2 2 4 7 6 1 18- 30 19- 10 20- 45 4 21- 22 22- 21 23- 44 6 24- 45 1 25- 45 3 26- 20 27- 45 2 28- 36 29- 20 30- 30 31- 45 1 32- 45 3 33- 40 34- 45 2 35- 2 36- 20 37- 30 38- 10 39- 45 4 40- 10 41- 43 22 42- 44 7 43- 45 6 44- 1 45- 30 84 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 86

6 4 1 6 2 1 5 5 7 62 n: Unused 46- 45 6 47- 45 4 48- 21 49- 1 50- 30 51- 36 52- 20 53- 10 54- 45 6 55- 10 56- 45 2 57- 45 1 58- 30 59- 20 60- 43 22 61- 44 5 62- 31 63- 45 6 64- 34 65- 21 66- 45 5 67- 34 68- 21 69- 45 7 70- 20 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 87

curve, press 12 . The resultant display is the curve constant "a". Constants "b" and "c" may be obtained by pressing 6 and 7 respectively. 8. To calculate a projected value, key in the number of the period and press . 9. Repeat step 8 for each period desired. Example: The X-presso Company - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 88

product's life? (Arrange the data as follows:) Group Group Group I II III 18 151 282 41 188 322 49 260 340 Keystrokes CLEAR 18 151 282 41 188 322 49 260 340 13 6 7 10 12 100 5 Display 0.00 of the weighted moving average which is readily adaptable to programmable calculator forecasting. 87 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 89

amount of up or down trend. When using exponential smoothing, a smoothing factor is chosen which affects the sensitivity of the average much the same way as the length of the standard moving average period HP 12C program: KEYSTROKES DISPLAY CLEAR 6 4 0 00- 01- 36 02- 36 03- 45 6 04- 30 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 90

- 40 2 18- 45 2 19- 16 20- 34 2 21- 44 2 22- 40 0 23- 45 0 24- 20 1 25- 45 1 3 26- 45 3 27- 20 28- 40 3 29- 44 3 1 30- 45 1 31- 20 0 32- 45 0 33- 10 2 34- 45 2 35- 40 36- 44 5 3 37- 45 3 0 38- 45 0 39- 10 2 40- 45 2 41- 40 89 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 91

Selecting the "best" smoothing constant (α): 1. Key in the program and press CLEAR . 2. Key in the number 1 and press . 3. Key in the error between the forecast value ( t+1) and the true value (Xt+1) 6. Press ; the display shows the next forecast ( t+2). 7. Optional: Press 5 to display - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 92

value just entered. . The output is the error in 5. Press period. . The displayed value represents the forecast for the next 6. in month 8 of 26, forecast the following month. Select the smoothing constant (α): Keystrokes Display CLEAR 0.00 1 1.00 .5 0 0.50 1 0.50 22 2 22.00 23 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 93

for several α's. Smoothing Constant (α) .5 .1 .25 .2 Cumulative Error (Σe2) 23.61 25.14 17.01 18.03 For the selected α = .25 St+1= 24.28 Tt-1 = 0.34 Dt+1= 25.64 Forecasting: Keystrokes CLEAR 1 .25 0 1 24.28 2 .34 3 25.64 6 26 5 0 2 3 6 Display 0.00 1.00 0.75 0.75 24.28 0.34 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 94

The following keystroke sequences are given to readily make these calculations on the HP-12C. CALCULATE GIVEN KEYSTROKES Selling Price Cost & Markup Key in cost, the selling price? What is the markup? Keystrokes Display 160 160.00 Cost. 1 20 20.00 Margin (%). 200.00 Selling price. 20 20 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 95

00 Markup (%). 14.00 Cost. 50 50.00 1 33.33 Margin (%). The following HP 12C program may be helpful for repetitive calculations of selling price and costs as well as conversions between markup and margin. KEYSTROKES DISPLAY CLEAR 04 1 00- 01- 36 02-43, 33 04 03- 16 04- 1 05- 34 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 96

03 Display 38.00 30.00 26.60 Selling price. Markup (%). Cost. 30 03 42.86 Markup (%). 26.6 50 00 26.60 39.90 Cost. New selling price. Calculations of List and Net prices With Discounts If it often useful to be able to quickly calculate list or net price when the other price and a series - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 97

What is the third discount rate? Keystrokes Display 1 1.00 1 48 1 1.00 5 1 1.00 1.45 0.49 3.28 1 100 10.51 3rd discount rate (%). The following program for the HP 12C will be helpful in performing the calculations: KEYSTROKES DISPLAY CLEAR 1 00- 01- 1 02- 34 03- 25 96 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 98

11- 34 12- 30 13- 26 14- calculate the unknown discount rate, key in the net price, press , key in the list price and press 07 . Example: Calculate the unknown discount rate for the previous example. If the list price is now raised to $3.75 what is the new net price? Keystrokes Display - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 99

1 1 48 5 1.45 3.28 07 3.75 1 1.00 0.52 0.95 10.51 0.89 1.66 3rd discount rate (%). Include 3rd discount rate in calculation. New net price. 98 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 100

Statistics Curve Fitting Exponential Curve Fit Using the function of the HP-12C, a least squares exponential curve fit may be easily calculated according to the equation y=AeBx. The exponential curve fitting technique is often used to determine the growth rate of a variable such as a stock's value - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 101

1978(3) 1979(4) 1980(5) 1981(6) 1982(7) Price 45 51.5 53.75 80 122.5 210 ? Keystrokes Display CLEAR 45 1 51.5 2 53.75 2 80 2 122.5 2 210 2 1.00 First data pair year 7 (1982). For repeated use of this routine, the following HP-12C program will be useful. KEYSTROKES DISPLAY 100 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 102

CLEAR 00 1 0 1 00 00- 01- 34 02- 43 23 03- 34 04- 49 05-43, 33 00 06- 43 2 07- 34 08- 31 09- 1 10- 43 2 11- 43 22 12- 0 13- 43 2 14- 43 22 15- 31 16- 34 17- 33 18- 10 19- 43 23 20- 31 21- 43 22 22- 1 23- 30 24- 31 25- 43 2 26- 43 22 27-43, 33 00 101 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 103

the x-value and press . For subsequent estimates, key in the x-value and press 25 . 8. For a different set of data, press CLEAR Keystrokes Display and go to step 2. CLEAR 1.00 45 1 51.5 2 2.00 53.75 3 3.00 80 4 4.00 122.5 5 5.00 210 6 6.00 06 0.95 First data pair input - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 104

end of year 7 (1982). If your data does not fit a line or an exponential curve, try the following logarithmic curve fit. This is calculated according to the equation y = A + B (ln x), and all x values must be positive. A typical logarithmic curve is shown below. The procedure is as follows: 103 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 105

many units will be sold by the end of eighth months? Month Cumulative Sales (units) 1 2 3 4 5 6 1431 3506 5177 6658 7810 8592 Keystrokes Display CLEAR 1431 1.00 First pair data input. 1 3506 2 2.00 Second pair data input. 5177 3 3.00 Third pair data input. 6658 4 4.00 Forth - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 106

is y = AxB, and the values for A and B are computed by calculations similar to linear regression. Some examples of power curves are shown below. The power curve according to the equation ln y = ln A + B(ln x): 1. Press CLEAR . 2. Key in the first y-value and press . Key in the first x-value and - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 107

. The following data are measurements Galileo might have made. t (pulses) h (feet) 2 2.5 3.5 4 4.5 30 50 90 130 150 Find the power curve formulas that best expresses h as a function of t (h = AtB). Keystrokes Display CLEAR 30 1.00 First pair data input. 2 50 2.00 Second pair data input - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 108

for $200 pre month, two rent for $205 per month, one rents for $216 per month, and one rents for $220 per month. What are the mean monthly rental and the standard deviation? What is the standard error of the mean? Keystrokes Display CLEAR 190 200 6.00 205 205 216 Total number of inputs - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 109

the mean, standard deviation, and standard error of the mean. 1. Press CLEAR . 2. Key in the first value and press . 3. Key in the respective frequency and press 0 display shows the number of data points entered. 4. Repeat steps 2 and 3 for each data point. 5. To calculate the mean (average - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 110

CLEAR 0 00 0 1 6 3 0 00 00- 01-44 40 0 02- 20 03- 49 04-43, 33 00 05- 45 0 06- 44 FV: Unused R1: Σfi R3: Σfixi2 R5: Σxi2 R7-R.7: Unused 1. Key in the program. 2. Press CLEAR REGISTERS i: Unused PMT: Unused R0: Σfi R2: Σfixi R4: Σxi R6: Σfixi2 . 3. Key in the first value and press . 109 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 111

Repeat steps 3 and 4 for each data point. 6. To calculate the mean, press 05 . The display shows the . 7. Press to find the standard deviation. 8. Press to find the standard error of the mean. 9. For a new case, go to step 2. Keystrokes Display CLEAR 190 1.00 First data pair. 54 195 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 112

be small. If the agreement is poor, x2 will be large. The following keystrokes calculate the x2 statistic: 1. Press CLEAR . 2. Key in the first Oi value and press . 3. Key in the is no need to store it in R0 each time.) Keystrokes Display CLEAR 25 1.25 20 0 0 17 20 1.70 0 111 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 113

that to a 0.05 significance level (probability = .95), the die is fair. Try the following HP-12C program with the same example. KEYSTROKES DISPLAY CLEAR 0 0 00 n: Unused PV: Unused FV: Unused R1-R.9: Unused 00- 01- 44 0 02- 30 03- 36 04- 20 05- 45 0 06- 10 07- 40 08-43, 33 00 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 114

, go to step 2. Keystrokes Display CLEAR 25 1.25 20 17 1.70 20 15 2.95 20 23 3.40 20 24 4.20 20 16 5.00 X2 20 Normal Distribution The normal (or Gaussian) distribution is an important tool in statistics and business analysis. The following HP-12C program gives an approximation - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 115

Relative error less than 0.042% over the range 0 < x < 5.5 Reference: Stephen E. Derenzo, "Approximations for Hand Calculators Using Small Integer Coefficients," Mathematics of Computation, Vol. 31, No. 137, page 214-225; Jan 1977. KEYSTROKES DISPLAY CLEAR 0 8 3 00010203114 44 0 8 3 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 116

04- 20 3 05- 3 115 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 117

5 1 0 5 6 2 7 0 3 0 1 6 5 2 00 n: Unused PV: Unused FV: Unused R1-R.6: Unused 1. Key in program. 2. Key in x and press 06- 5 07- 1 08- 40 09- 45 0 10- 20 11- 5 12- 6 13- 2 14- 40 15- 7 16- 0 17- 3 18- 45 0 19- 10 20- 1 21- 6 22- 5 23- 40 24- 10 25- 16 26- 43 22 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 118

. 5. Press 1 1 1 to obtain S'xy. Example 1: Find the sample covariance (Sxy) and population covariance (S'xy) for the following paired variables: xi 26 30 44 50 62 68 74 yi 92 85 78 81 54 51 40 Keystrokes Display CLEAR 92 26 85 30 7.00 Total number of entries. 78 44 81 50 117 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 119

1 1 1 -303.55 S'xy Try the previous example using the following HP-12C program: KEYSTROKES DISPLAY CLEAR 00 1 1 00 00- 01- 49 02-43, 33 00 03- 43 48 04- 20 05- 36 06- 43 2 07- 33 08- 20 09- 31 10- 45 1 11- 1 12- 30 13- 45 1 14- 10 15- 20 16-43, 33 00 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 120

3 and 4 for all data pairs. 5. Press 03 . to obtain the value of Sxy. 6. Press to obtain S'xy. 7. For a new case, go to step 2. Keystrokes Display CLEAR 92 26 85 30 78 44 7.00 Total number of entries. 81 50 54 62 51 68 40 74 03 -354.14 Sxy -303.55 S'xy Permutation - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 121

where m, n are integers and 69 ≥ m ≥ n ≥ 0. Use the following HP-12C program to calculate the number of possible permutations. KEYSTROKES DISPLAY CLEAR 0 0 00 00- 01- 44 0 02- 34 03- 43 3 04- 43 36 05- 45 0 06- 30 07- 43 3 08- 10 09-43, 33 00 n: Unused PV: Unused FV - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 122

4 Combination A combination is a selection of one or more of a set of distinct objects Use the following HP-12C to calculate the number of possible combinations. KEYSTROKES DISPLAY CLEAR 0 0 0 00 n: Unused PV: Unused 00- 01- 44 0 02- 34 03- 43 3 04- 43 36 05- 45 0 06- 30 07- 43 3 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 123

selected? Keystrokes Display 7 35.00 7C3. 3 Random Number Generator This HP-12C program calculates uniformly distributed wise to statistically test other seeds before using them. ) The period of this generator has a length of 500,000 numbers and DISPLAY CLEAR 5 00- 01- 48 02- 5 122 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 124

R0: Ui 1. Key in the program. 2. To generate a random number, press . 3. Repeat step 2 as many times as desired. Example: Generate a sequence of 5 random numbers. Keystrokes Display 0.83 0.83 0.83 0.83 0.83 123 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 125

A negative sign is the convention for cash paid out). Example: What would your monthly payments be on a $65,000 house in a neighborhood with a $25 per thousand tax rate and a 10 3/4 % interest rate on a 35 year loan with 10% down? Keystrokes Display CLEAR 10.75 35 65000 1 10 25 1 12000 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 126

-672.16 Approximate monthly payment. The following HP-12C program may be used instead of the above. KEYSTROKES DISPLAY CLEAR 1 2 3 1 2 3 00 00- 01- 43 8 02- 45 1 03- 45 2 04- 25 05- 30 06- 13 07- 36 08- 43 36 09- 40 10- 45 3 11- 20 12- 1 13- 2 14- 26 15- 3 16- 10 17 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 127

3. 8. To calculate the approximate monthly payment, press . 9. For a new case, store only the new variables by performing steps 3 thru 7 as needed. Press for the new approximate monthly payment. Example: Solve the previous example using the HP-12C program.. Keystrokes Display CLEAR 10.75 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 128

for maximum accuracy. • The assumed 10% annual inflation rate may be changed by modifying the program at lines 19 and 20. • The assumed tax rate used to calculate the after tax value of the tax-free investment may be changed by modifying the program at line 9. KEYSTROKES DISPLAY CLEAR 00- 01 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 129

1 5 1 1 1 0 1 1 17 06- 31 07- 45 1 08- 48 09- 5 10- 25 11- 16 12- 1 13- 40 14- 45 15 15- 20 16- 31 17- 1 18- 48 19- 1 20- 0 21- 45 11 22- 21 23- 10 24- 31 25- 45 12 26- 1 27- 45 1 28- 25 29- 30 30- 20 31- 12 32- 15 33- 31 34-43, 33 17 128 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 130

2. Press CLEAR REGISTERS i: calculate the future value of the tax free investment. to compute the total cash Assuming a 35 year investment period with a dividend rate of 8. cash form the account at a rate such that it will be taxed at a rate equal to one-half the rate paid during the pay-in period - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 131

you invest the same amount ($1500, *after taxes for a not-Keogh or IRA account.) each year with dividends taxed as ordinary income, what will be the total tax-paid cash at retirement? 7. What is the purchasing power of that figure in terms of today's dollars? Keystrokes Display CLEAR 40.00 Tax - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 132

25 5/8 is input as 25.58. • The beta coefficient analysis is optional. Key in 1.00 if beta is not to be analyzed. KEYSTROKES DISPLAY CLEAR 6 15 1 0 1 0 6 4 38 4 7 00- 01- 44 6 02- 43 24 03- 43 35 04-43, 33 - 40 18- 45 4 19- 43 35 20-43, 33 38 21-44 30 4 22- 20 23- 45 7 24- 20 131 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 133

0 7 1 3 5 01 7 5 2 1 4 01 2 0 25-44 40 0 26- 34 27- 45 7 28- 20 29-44 40 1 30- 33 31- 20 32-44 40 3 33- 45 5 34- 43 36 35- 24 36- 31 37-43, 33 01 38- 40 39- 34 40- 44 7 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 134

. Val. R4: Flag R6: XXX.ND R8-R.1: Unused Instructions: 1. Key in the program. 2. Initialize the program by pressing CLEAR . 3. Key in the number of shares of a stock the stock and press . The display will show the percent change in the stock value. 8. Repeat steps 3 through 7 until all - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 135

500 65 1/4 .6 $3.50 64 3/8 N.W. Sundial Keystrokes CLEAR 100 25.58 .8 1.70 27.14 200 30.14 1.2 2.10 33.12 50 Display 0.00 100.00 1.00 0.80 1.70 6.34 200.00 1.00 1.20 2.10 10.74 50.00 Int'l Heartburn Percent change in Stock's value. P. D. Q. Percent change in Stock's value. Datacrunch 134 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 136

65.14 .6 3.50 64.38 48 1.00 1.30 4.55 6.95 500.00 1.00 0.60 3.50 -1.34 45,731.25 46,418.75 1.50 2,567.50 5.53 0.77 Percent change in Stock's value. N. W. Sundial Percent change in Stock's value. Original value. Present value. Percent change in value. Total yearly dividend. Annual dividend yield - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 137

Periodic Payment Amount Example 1: What is the monthly payment required to fully amortize a 30year, $30,000 Canadian mortgage if the interest rate is 9%? Keystrokes Display CLEAR 6 200 9 30 30000 0 0.74 Canadian mortgage factor 360.00 -237.85 Total monthly periods in mortgage life - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 138

Number of Periodic Payments to Fully Amortize a Mortgage Example 2: An investor can afford to pay $440 per month on a $56,000 Canadian Mortgage. If the annual interest rate is 9 1/4 %, how long will it take to completely amortize this mortgage? Keystrokes Display CLEAR 6 200 9.25 440 56000 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 139

CLEAR 6 200 8.75 612.77 10 75500 0.72 Canadian Mortgage factor. -61,877.18 Outstanding balance remaining at the end of 10 years. 138 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 140

by a predictable amount. The learning factor the learning factor may change, especially after large calculated. In addition, it is possible to calculate Cij, the average cost of the ith thru jth unit. These calculations may be rapidly done with the following HP-12C program: KEYSTROKES DISPLAY - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 141

CLEAR 2 2 1 2 2 00 2 2 1 00 3 00- 01- 43 23 02- 2 03- 43 23 04- 10 05- 44 2 06- 33 07- 34 08- 44 1 09- 10 10- 43 23 11- 45 2 12- 10 13- 43 22 14- 44 2 15-43, 33 00 16- 45 2 17- 43 23 18- 2 19- 43 23 20- 10 21- 21 22- 45 1 23- 20 24-43, 33 00 25- 44 3 26- 34 140 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 142

: Unused R1: C1 R3: i 27- 44 4 28- 45 2 29- 43 23 30- 2 31- 43 23 32- 10 33- 1 34- 40 35- 44 0 36- 21 37- 45 3 38- 45 0 39- 21 40- 30 41- 45 0 42- 10 43- 45 4 44- 45 3 45- 30 46- 10 47- 45 1 48- 20 49-43, 33 00 REGISTERS - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 143

press . c. Key in n, the number of units and press learning factor. to calculate r the 3. To calculate the cost of the nth unit when C1 and r are known: a. Key in of units 500 thru 1000. (Recall that C1 was $875). Keystrokes Display 875 875.00 395 395.00 100 0.89 Actual r. 500 16 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 144

these probabilities are available and can be used to aid in quick solutions. Using the assumptions outlined above and a suitable table giving mean waiting time as a multiple of mean service (see page 512 of the Reference) the following keystroke solutions may be obtained: 1. Key in the arrival - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 145

average number of customers in the queue? In the system? Keystrokes 1.2 .5 3 Display 1.20 2.40 0.80 ρ, intensity factor. ρ / n From Table 12.2, page 512 of the reference, the mean waiting time as a multiple of mean service time for n = 3, ρ/n = 0.8 is 1.079. (Note S is used instead of n in the - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 146

system. 1 1.25 Average # customers in system. With an HP-12C program on can readily calculate the necessary probabilities for this type of problem (dispensing with the use of tables) and perform additional calculations as well. KEYSTROKES DISPLAY CLEAR 1 0 0 0 0 09 16 00- 01- 1 02-44 33 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 147

-43, 33 01 16-45 48 0 17- 45 7 18- 21 19- 1 20-45 48 0 21- 45 7 22- 10 23- 30 24- 10 25- 45 7 26- 43 3 27- 10 28- 44 6 29- 45 2 30- 40 31- 22 32- 44 1 33- 45 6 34- 20 35- 44 2 36-45 48 0 37- 20 38- 45 7 39 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 148

4 46- 45 8 47- 10 48- 44 5 49- 45 3 50- 45 8 51- 10 52- 44 6 53- 31 54- 45 8 55- 45 7 56- 45 9 57- 20 58- 30 59- 20 60- 43 22 61- 45 2 62- 20 63-43, 33 53 REGISTERS i: Unused PMT: Unused R0: K R2: Pb R4: L R6: Used, Tq 147 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 149

service rate of each server, µ, and press 9. 5. Press 0 to calculate and store ρ, the intensity factor. 6. Press to see Tq, the average waiting time in the queue. Display that a customer will have to wait 2 minutes or more? Keystrokes Display CLEAR 0.00 3 0 7 3.00 n 1.2 8 1.20 λ .5 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 150

2 3 4 5 2 0.65 Pb probability all servers are busy. 2.59 Lq average # waiting in queue. 4.99 L, average # waiting in system. 4.16 T, average total time in system. 0.36 Probability of having to wait 2 minutes or more. 149 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 151

-around mortgage as a decimal. • FV = balloon payment. • PV2 - PV1 = -P----M-----T----2---[--1 1-----+-----r---)-----n---2---]r - P-----M-----T----1---[--1 1-----+-----r---)-----n---1---]r + F V ( 1 + r )-n 2 After-Tax Cash Flows • ATCFk = After-Tax Cash Flow for kth year. • Intk - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 152

Lending Loans with a constant amount paid towards Principal • BALk = remaining balance after time period k. • CPMT = Constant payment to principal. • BALk = PV - (k x CPMT) • Kth i 12 Add-On to APR with Credit Life • CL = credit life as decimal. • AMT = loan amount. • FC = finance charge. 1 + - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 153

= (n - k) x PMT - Rebatek Skipped Payments • A = number of payments per year. • B = number of years. • C = annual percentage rate as decimal. • D = periodic payment amount. • E = loan amount. • K = number of last payment before payments close the first time. • L = number of skipped payment. DEND - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 154

per year. • P = number of payments periods per year. • i = periodic interest rate, expressed as a percentage. • r = i / 100, periodic interest rate expressed as a decimal. • iPMT = ((1 + r / C)C/P - 1)100 Investment Analysis Lease vs. Purchase • PMTp = loan payment for purchase. • PMTL = lease - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 155

of net sales price. Securities Discounted Notes Price (given discount rate) • B = number of days in year (annual basis). • DR = discount rate (as a decimal). • DSM = number of days from settlement date to maturity date. • P = dollar price per $100 per value. • RV = redemption value per $100 par - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 156

X-----2----+-----X----3----+-----X-.--.-M--.--x--M--m X---------m------2 1---- m • SV = Seasonal variation factor. • xi = value of the ith data point. • i = centered moving average of the ith data point. • SV = X----i Xi Gompertz Curve Trend Analysis • y = ca(bx) • where x, y, a, b, and - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 157

∑ S2 = Inyi = n ln c + bn + 1( ln a) -b-b--n---------1--1- i = n+1 • • a, b and c are determined by solving the three equations above simulta- neously. Forecasting With Exponential Smoothing • a = smoothing constant (0 < a < 1) • Xt = actual current period usage 156 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 158

St - 1 • Change, Ct = St - St - 1 • Trend, Tt = αCt + (1 - α)Tt - 1 • Current period expected usage, • Forecast of next period expected usage, • Error, et = t - Xt • ∑ Cumulative error = et2 t=1 • Initial conditions: St-1 = Xt-1 Tt-1 = 0 Pricing Calculations Markup and Margin Calculations • Ma - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 159

• Ma = 100S-----------C--S • Mu = 100S-----------C--C • S = --------C----------- 1 - -M-----a--100 • S = C1 + 1-M---0---u0-- • C = S 1 - 1-M---0--a-0-- • C = ---------S---------1 + 1-M---0---u0-- • Ma = ------M------u------1 + -M-----u--100 • Mu = ------M------a------1 + - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 160

Calculations of List and Net Prices with Discounts • L = List price. • N = Net price. • D = Discount(%). • D' = 1 - ---D-----100 • L = -D----'-1----×-----D----'--2---N-×-----S.--.--S.----D----'-D-x----F-- • Dx = 1 - - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 161

(---Σ----l--n---x----i l--n---y----i-)- B n Σ( ln xi ) 2 - (---Σ----l--n---x----i-)--2n • A = exp -Σ----l-n----y---i - BΣ-----l-n----x---i n n • = AxB Standard Error of the Mean • SX = S-----X-n Sy = -S----yn Mean, Standard Deviation, Standard Error for Grouped Data 160 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 162

standard error Sx = Σfi Personal Finance Tax-Free Retirement Account (IRA) or Keogh Plan • n = the number of years to retirement. • i = the compunded annual interest. • PMT = the earnings used for investment (and taxes). • FV= future value. • tax= the percent tax expressed as a decimal. For - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 163

β = -P----i-S----i--β---i T T Canadian Mortgages • r = annual interest rate expressed as a decimal. • monthly factor 1-- = 1 + 2-r- 6 j--k----+---1----------i--k---+----1k+1 • This formula is only approximate and may give appreciable error at small i. 162 - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 164

Queuing and Waiting Theory • n = number of servers. • λ = arrival rate of customers (Poisson input). • µ = service rate for each server (exponential service). • ρ = Intensity factor n for valid results). • P0 = Probability that all servers are idle. • Pb = Probability that all servers are busy. • - HP 12C#ABA | hp 12c_solutions handbook_English_E.pdf - Page 165

I + 1 + I)AB where: • Q = ---1-----+-----C------ - 1 (1 + I)A • A = number of payments per year • B = number of years that payments increase • C = percentage increase in periodic payments (as a decimal) • PMT1 = amount of the first payment 164