HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 151

Appendix, Real Estate

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 151 highlights

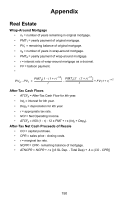

Appendix Real Estate Wrap-Around Mortgage • n1 = number of years remaining in original mortgage. • PMT1 = yearly payment of original mortgage. • PV1 = remaining balance of original mortgage. • n2 = number of years in wrap-around mortgage. • PMT2 = yearly payment of wrap-around mortgage. • r = interest rate of wrap-around mortgage as a decimal. • FV = balloon payment. • PV2 - PV1 = -P----M-----T----2---[--1 1-----+-----r---)-----n---2---]r - P-----M-----T----1---[--1 1-----+-----r---)-----n---1---]r + F V ( 1 + r )-n 2 After-Tax Cash Flows • ATCFk = After-Tax Cash Flow for kth year. • Intk = interest for kth year. • Depk = depreciation for kth year. • r = appropriate tax rate. • NOI = Net Operating Income. • ATCFk = NOI (1 - r) - 12 x PMT + r x (Intk + Depk). After-Tax Net Cash Proceeds of Resale • CO = capital purchase. • CPR = sales price - closing costs. • r = marginal tax rate. • NCPR = CPR - remaining balance of mortgage. • ATNCPR = NCPR + r x [(.6 SL Dep. - Total Dep) + .4 x (CO - CPR)] 150