HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 50

Instructions

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 50 highlights

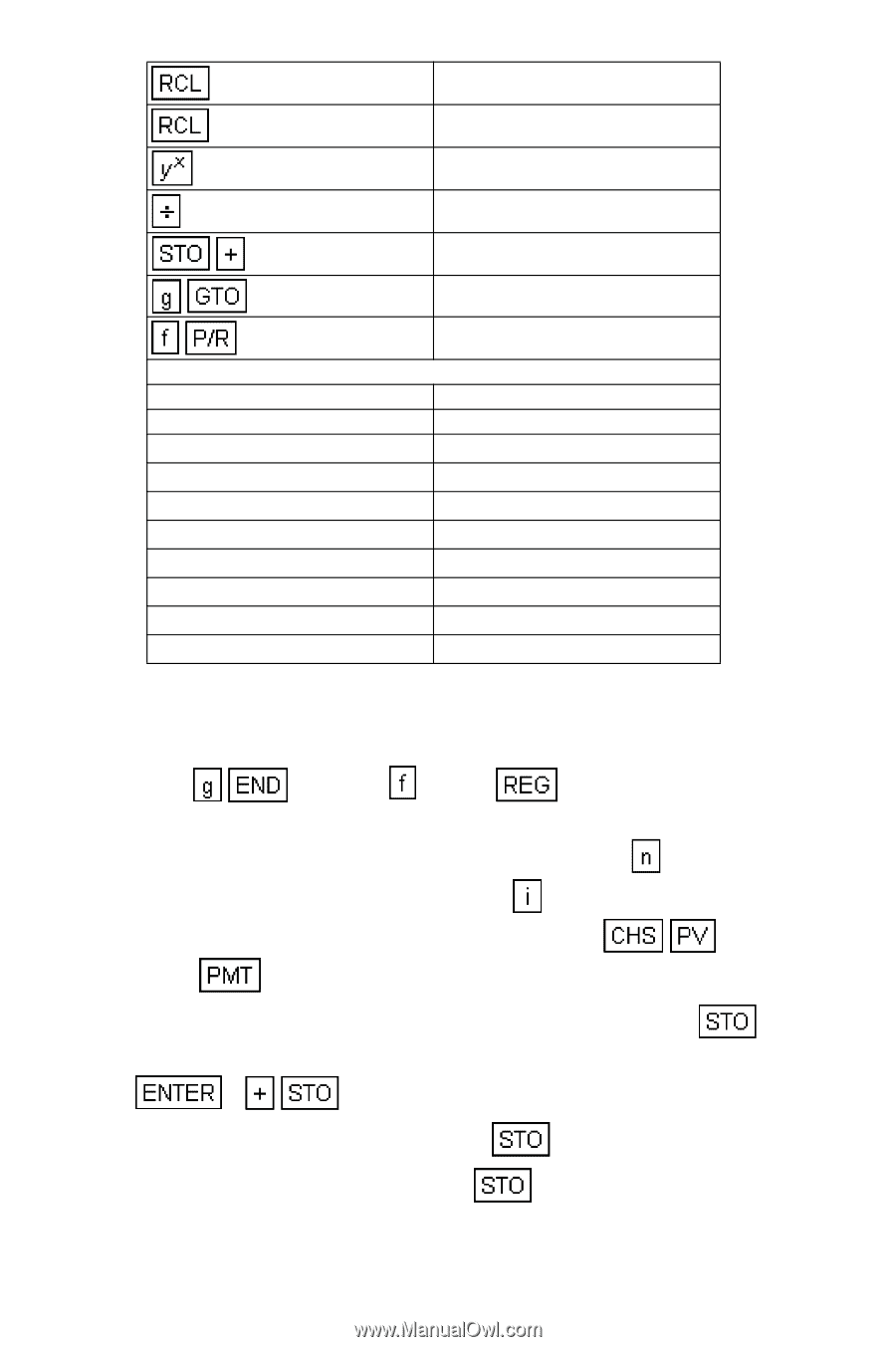

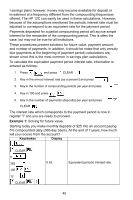

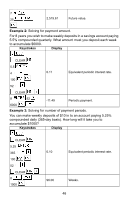

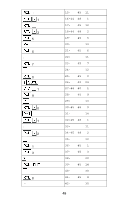

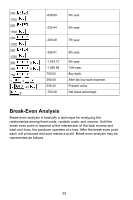

4 0 2 00 43- 45 4 44- 45 0 45- 21 46- 10 47-44 40 2 48-43, 33 00 n: Used PV: Used FV: 0 R1: Used R3: Tax R5: Dep. Value R7: Factor (DB) R9: Used R.1: Used R.3: Unused REGISTERS i: Used PMT: Used R0: Used R2: Purch. Adv. R4: Discount R6: Dep. life R8: Used R.0: Used R.2: Used Instructions: 1. Key in the program. -Select the depreciation function and key in at line 26. 2. Press and press CLEAR . 3. Input the following information for the purchase of the loan: -Key in the number of years for amortization and press . -Key in the annual interest rate and press . -Key in the loan amount (purchase price) and press . -Press to find the annual payment. 4. Key in the marginal effective tax rate (as a decimal) and press 3. 5. Key in the discount rate (as a decimal) or cost of capital and press 1 4. 6. Key in the depreciable value and press 5. 7. Key in the depreciable live and press 6. 49