HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 14

Example 1, Assuming a 125% declining balance depreciation, what are the After-Tax - functions

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

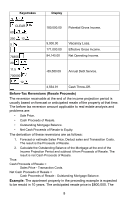

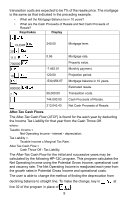

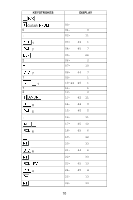

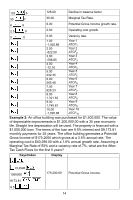

Page 14 highlights

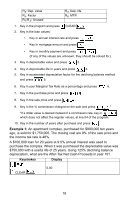

5. Key in depreciable value and press 4. 6. Key in depreciable life and press 5. 7. Key in factor (for declining balance only) and press 6. 8. Key in the Marginal Tax Rate (as a percentage) and press 7. 9. Key in the growth rate in Potential Gross Income ( 0 for no growth) and press 8. 10. Key in the growth rate in operational cost (0 if no growth) and press 9. 11. Key in the vacancy rate (0 for no vacancy rate) and press 0. 12. Key in the desired depreciation function at line 32 in the program. 13. Press to compute ATCF. The display will pause showing the year and then will stop with the ATCF for that year. The Y-register contains the year. 14. Continue pressing to compute successive After-Tax Cash Flows. Example 1: A triplex was recently purchased for $100,000 with a 30-year loan at 12.25% and a 20% down payment. Not including a 5% annual vacancy rate, the potential gross income is $9,900 with an annual growth rate of 6%. Operating expenses are $3,291.75 with a 2.5% growth rate. The depreciable value is $75,000 with a projected useful life of $20 years. Assuming a 125% declining balance depreciation, what are the After-Tax Cash Flows for the first 10 years if the investors Marginal Tax Rate is 35%? Keystrokes Display CLEAR 100000 20 12.25 30 9900 2 3291.75 3 75000 4 20 5 80,000.00 Mortgage amount. 1.02 360 -838.32 9,900.00 3,291.75 75,000.00 20.00 Monthly interest rate. Mortgage term. Monthly payment. Potential Gross Income. 1st year operating cost. Depreciable value. Useful life. 13