HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 22

Add-On Interest Rate Converted to APR

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 22 highlights

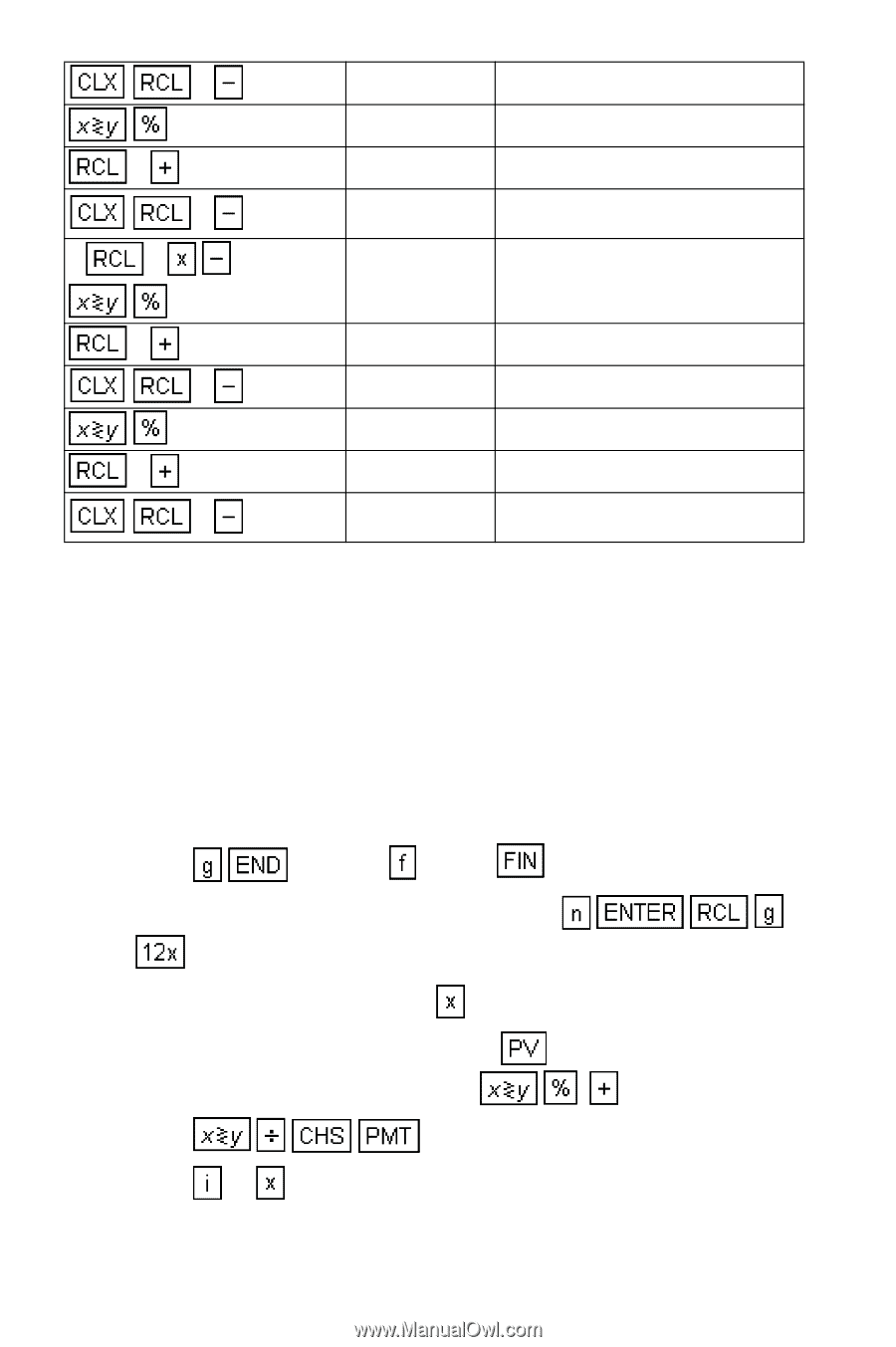

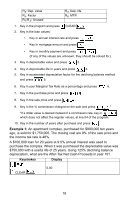

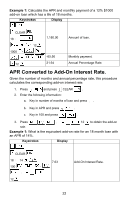

0 0 0 4 0 55,000.00 2,750.00 7,750.00 50,000.00 1,500.00 Remaining balance. Second payment's interest. Total second payment. Remaining balance after the first year. Seventh payment's interest. 0 0 6,500.00 25,000.00 1,250.00 Total seventh payment. Remaining balance. Eighth payment's interest. 0 0 6,250.00 20,000.00 Total eighth payment. Remaining balance after fourth year. Add-On Interest Rate Converted to APR An add-on interest rate determines what portion of the principal will be added on for repayment of a loan. This sum is then divided by the number of months in a loan to determine the monthly payment. For example, a 10% add-on rate for 36 months on $3000 means add one-tenth of $3000 for 3 years (300 x 3) - usually called the "finance charge" - for a total of $3900. The monthly payment is $3900/36. This keystroke procedure converts an add-on interest rate to a annual percentage rate when the add-on rate and number of months are known. 1. Press and press CLEAR . 2. Key in the number of months in loan and press . 3. Key in the add-on rate and press . 4. Key in the amount of the loan and press received; negative for cash paid out.) 5. Press . * (*Positive for cash . 6. Press 12 to obtain the APR. 21