HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 162

Personal Finance, the number of issues held.

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 162 highlights

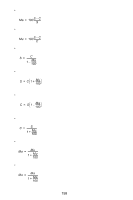

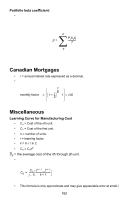

• mean X = Σ---Σ-f--i-f-x-i-i • standard deviation Sx = Σ----f--i--x---i2Σ-----f--i---(---Σ--1--f--i-)---X----2• standard error Sx = Σfi Personal Finance Tax-Free Retirement Account (IRA) or Keogh Plan • n = the number of years to retirement. • i = the compunded annual interest. • PMT = the earnings used for investment (and taxes). • FV= future value. • tax= the percent tax expressed as a decimal. For ordinary taxable investment: • FV = i--(---1-P-----M----t--Ta----x---)-[1 + i(1 - tax)]{[1 + i(1 - tax)]n - 1} For tax-free investment: • FV = P-----M-----T-- (1 + i)[(1 + i)n - 1] i Stock Portfolio Evaluation and Analysis • n = the number of issues held. • Pi = the current market price / share of a stock. • Si = the number of shares of a stock held. • βi = the beta coefficient of an individual stock. • T = the total present value of a portfolio. 161