HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 64

b. Press 12 43 ., At 32% operating expense and $3.25 manufacturing cost, what should

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 64 highlights

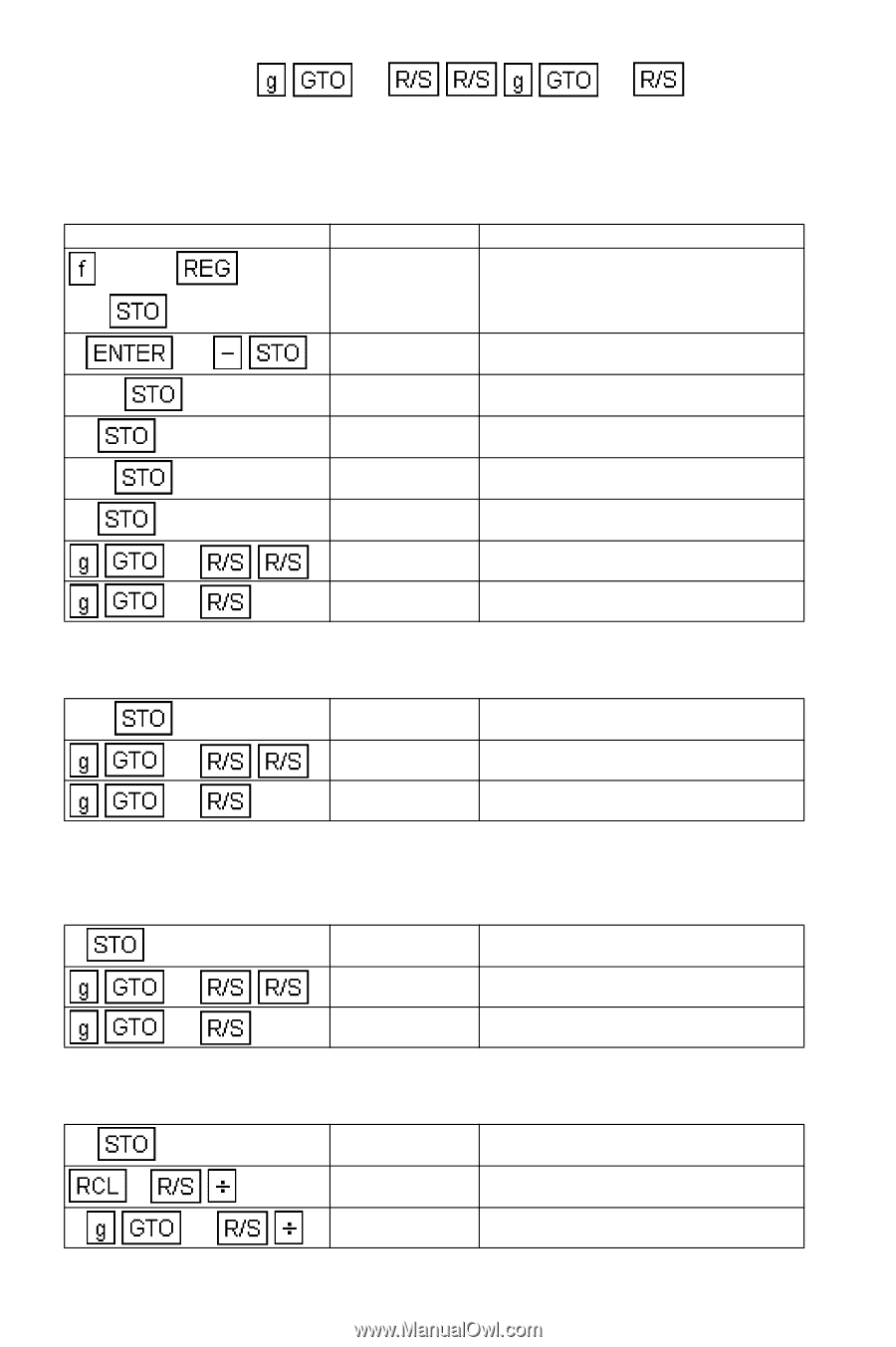

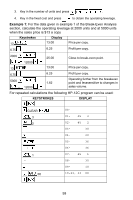

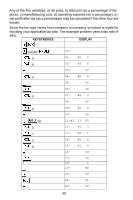

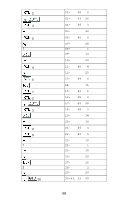

b. Press 12 43 . Example: What is the net return on an item that is sold for $11.98, discounted through distribution an average of 35% and has a manufacturing cost of $2.50? The standard company operating expense is 32% of net shipping (sales) price and tax rate is 48%. Keystrokes Display CLEAR 100 0 100.00 1 .48 6 0.52 48% tax rate. 11.98 1 11.98 List price ($). 35 2 35.00 Discount (%). 2.50 3 2.50 Manufacturing cost ($). 32 4 12 32.00 67.90 Operating expenses (%). 43 18.67 Net profit (%). If manufacturing expenses increase to $3.25, what is the effect on net profit? 3.25 3 3.25 Manufacturing cost. 12 58.26 43 13.66 Net profit reduced to 13.66% If the manufacturing cost is maintained at $3.25, how high could the overhead (operating expense) be before the product begins to lose money? 0 5 0.00 12 58.26 38 58.26 Maximum operating expense (%). At 32% operating expense and $3.25 manufacturing cost, what should the list price be to generate 20% net profit? 20 5 3 1 14 20.00 11.00 16.93 List price ($). 63