HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 125

Personal Finance, Homeowners Monthly Payment Estimator

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 125 highlights

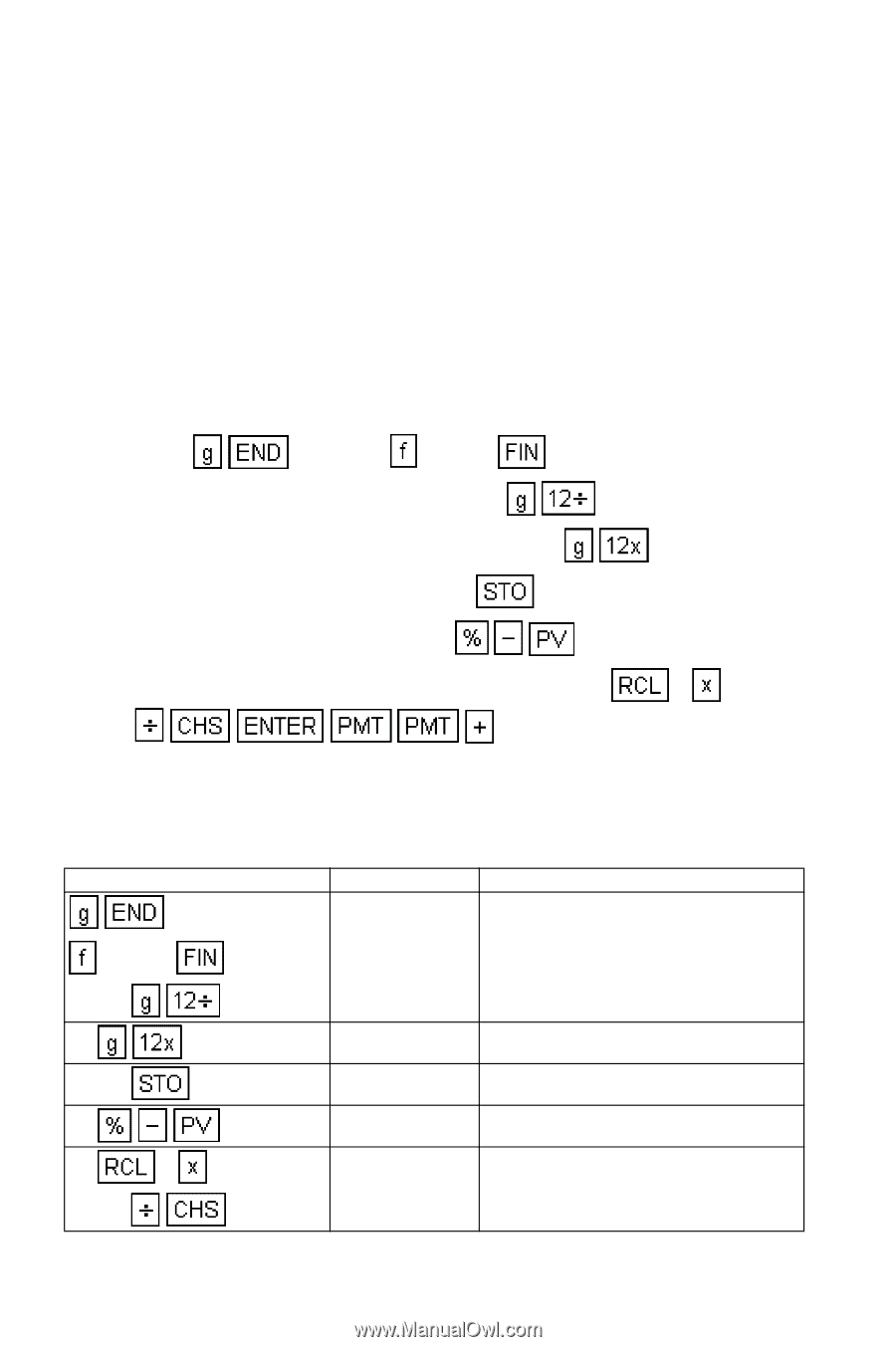

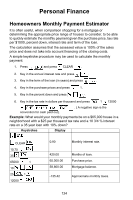

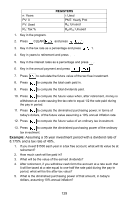

Personal Finance Homeowners Monthly Payment Estimator It is often useful, when comparison shopping for a mortgage or determining the appropriate price range of houses to consider, to be able to quickly estimate the monthly payment given the purchase price, tax rate per $1000, percent down, interest rate and term of the loan. The calculation assumes that the assessed value is 100% of the sales price and does not take into account financing of the closing costs. A simple keystroke procedure may be used to calculate the monthly payment: 1. Press and press CLEAR . 2. Key in the annual interest rate and press . 3. Key in the term of the loan (in years) and press . 4. Key in the purchase prices and press 1. 5. Key in the percent down and press . 6. Key in the tax rate in dollars per thousand and press 1 12000 . ( A negative sign is the convention for cash paid out). Example: What would your monthly payments be on a $65,000 house in a neighborhood with a $25 per thousand tax rate and a 10 3/4 % interest rate on a 35 year loan with 10% down? Keystrokes Display CLEAR 10.75 35 65000 1 10 25 1 12000 0.90 Monthly interest rate. 420.00 65,000.00 58,800.00 -135.42 Months of loan. Purchase price. Mortgage balance. Approximate monthly taxes. 124