HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 6

Example 2, A customer has an existing mortgage with a balance - how to clear

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 6 highlights

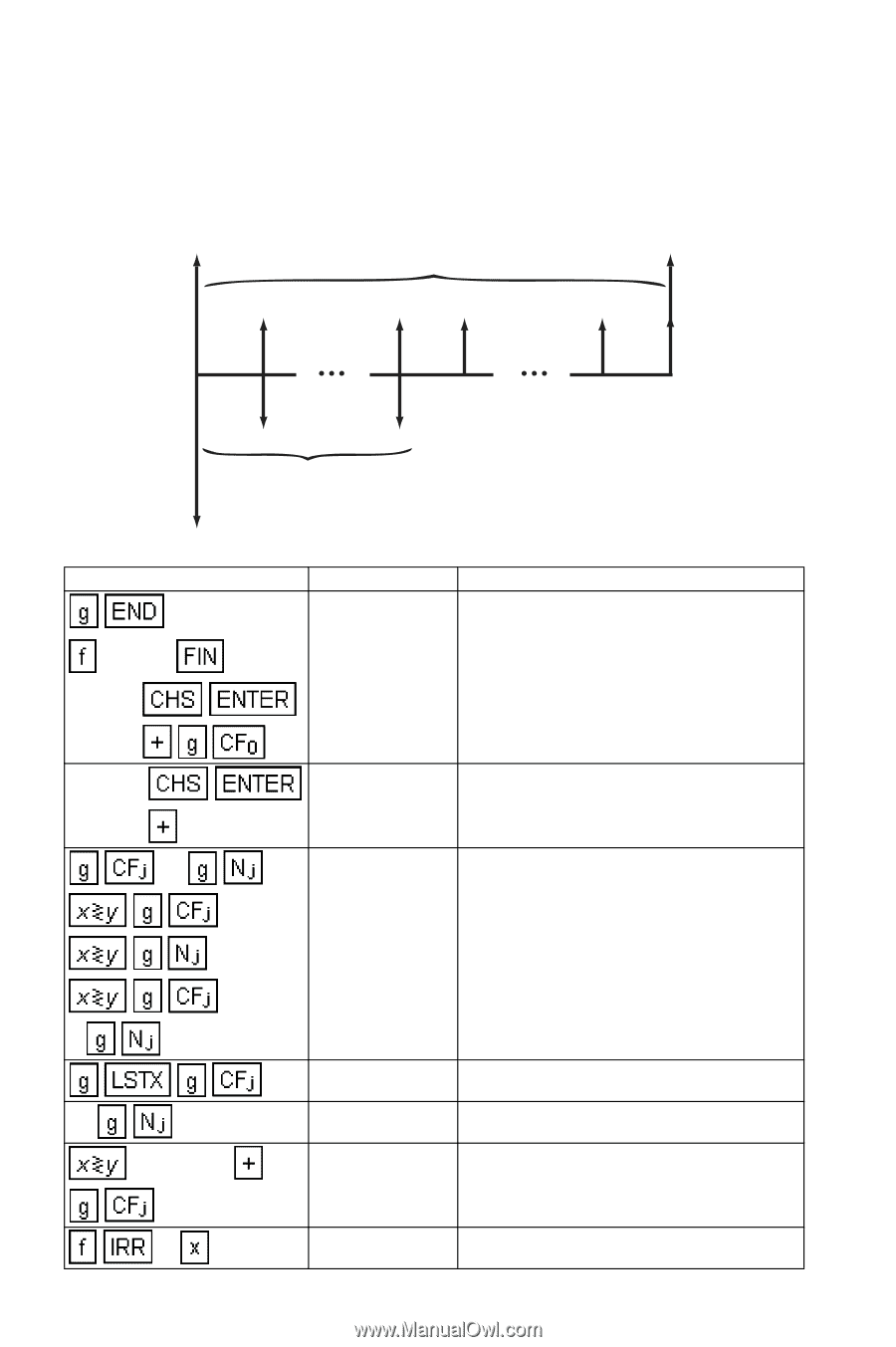

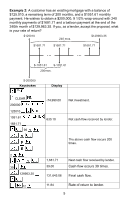

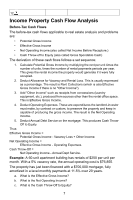

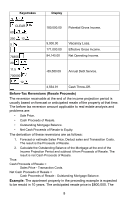

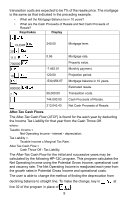

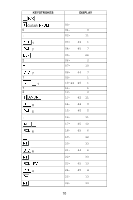

Example 2: A customer has an existing mortgage with a balance of $125.010, a remaining term of 200 months, and a $1051.61 monthly payment. He wishes to obtain a $200,000, 9 1/2% wrap-around with 240 monthly payments of $1681.71 and a balloon payment at the end of the 240th month of $129,963.35. If you, as a lender, accept the proposal, what is your rate of return? $125010 240 mos. $129963.35 $1681.71 $1681.71 $1681.71 $-1051.61 $-1051.61 200mos. $-200000 Keystrokes Display CLEAR 200000 125010 1051.61 1681.71 99 2 39 129963.35 12 -74,990.00 Net investment. 630.10 Net cash flow received by lender. The above cash flow occurs 200 times. 1,681.71 39.00 Next cash flow received by lender. Cash flow occurs 39 times. 131,645.06 Final cash flow. 11.84 Rate of return to lender. 5