HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 70

a. Key in the discount rate and press 5., b. Press to calculate the purchase price.

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

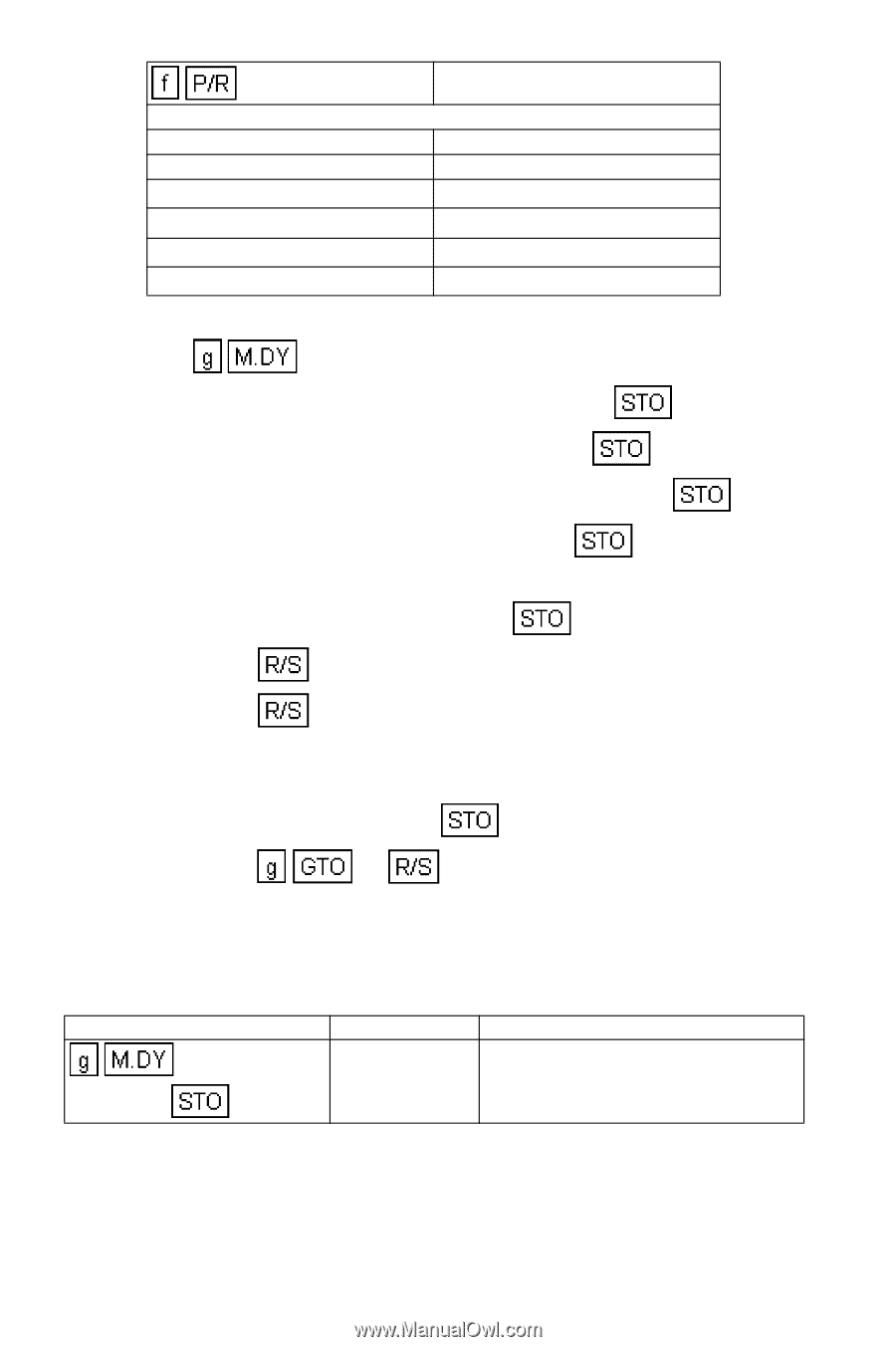

Page 70 highlights

n: Unused PV: Unused FV: Unused R1: Settl. date R3: 360 or 360 R5: dis./price 1. Key in the program. 2. Press . REGISTERS i: Unused PMT: Unused R0: Unused R2: Mat. date R4: redemp. value R6-R.5: Unused 3. Key in the settlement date (MM.DDYYYY) and press 1. 4. Key in the maturity date (MM.DDYYYY) and press 2. 5. Key in the number of days in a year (360 or 365) and press 3. 6. Key in the redemption value per $100 and press 4. 7. To calculate the purchase price: a. Key in the discount rate and press 5. b. Press to calculate the purchase price. c. Press to calculate the yield. d. For a new case, go to step 3. 8. To calculate the yield when the price is known: a. Key in the price and press 5. b. Press 15 to calculate the yield. c. For a new case, go to step 3. Example 1: Calculate the price and yield on this U.S. Treasury Bill: settlement date October 8, 1980; maturity date March 21, 1981; discount rate 7.80%. Compute on a 360 day basis. Keystrokes Display 10.081920 1 10.08 Settlement date. 69