HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 131

Stock Portfolio Evaluation and Analysis - business calculator

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 131 highlights

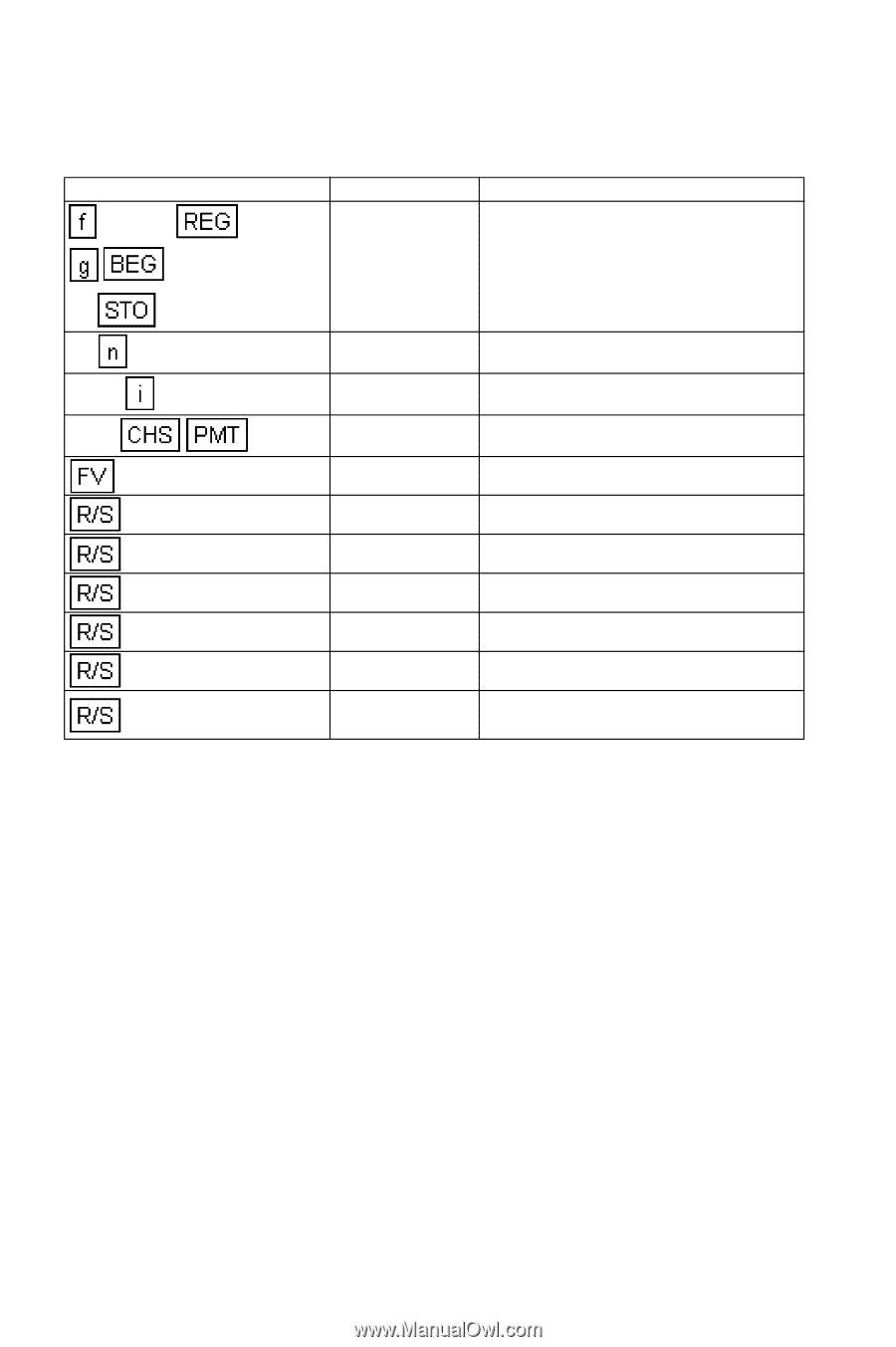

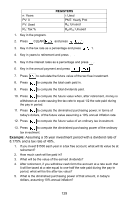

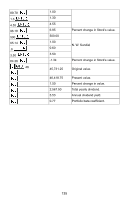

6. If you invest the same amount ($1500, *after taxes for a not-Keogh or IRA account.) each year with dividends taxed as ordinary income, what will be the total tax-paid cash at retirement? 7. What is the purchasing power of that figure in terms of today's dollars? Keystrokes Display CLEAR 40.00 Tax rate. 40 1 35 8.175 1500 35.00 8.18 -1,500.00 290,730.34 -52,500.00 238,230.34 232,584.27 8,276.30 139,360.09 4,959.00 Years to retirement. Dividend rate. Annual payment. Future value at retirement. Cash Paid in. Earned dividends. After-tax value. Diminished purchasing power. Tax-paid cash at retirement. Purchasing power of tax-paid cash at retirement. Stock Portfolio Evaluation and Analysis This program evaluates a portfolio of stocks given the current market price per share and the annual dividend. The user inputs the initial purchase price of a stock, the number of shares, the beta coefficient*, the annual dividend, and the current market price for a portfolio of any size. The program returns the percent change in value of each stock and the valuation and beta coefficient* of the entire portfolio. Output includes the original portfolio value, the new portfolio value, the percent change in the value and the annual dividend and yield as a percent of the current market value. The overall beta coefficient of the portfolio is also calculated. *The beta coefficient is a measure of a stock variability (risk) compared to the market in general. Beta values for individual stocks can be acquired from brokers, investment publications or the local business library. Notes: 130