HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 68

Discounted Notes

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 68 highlights

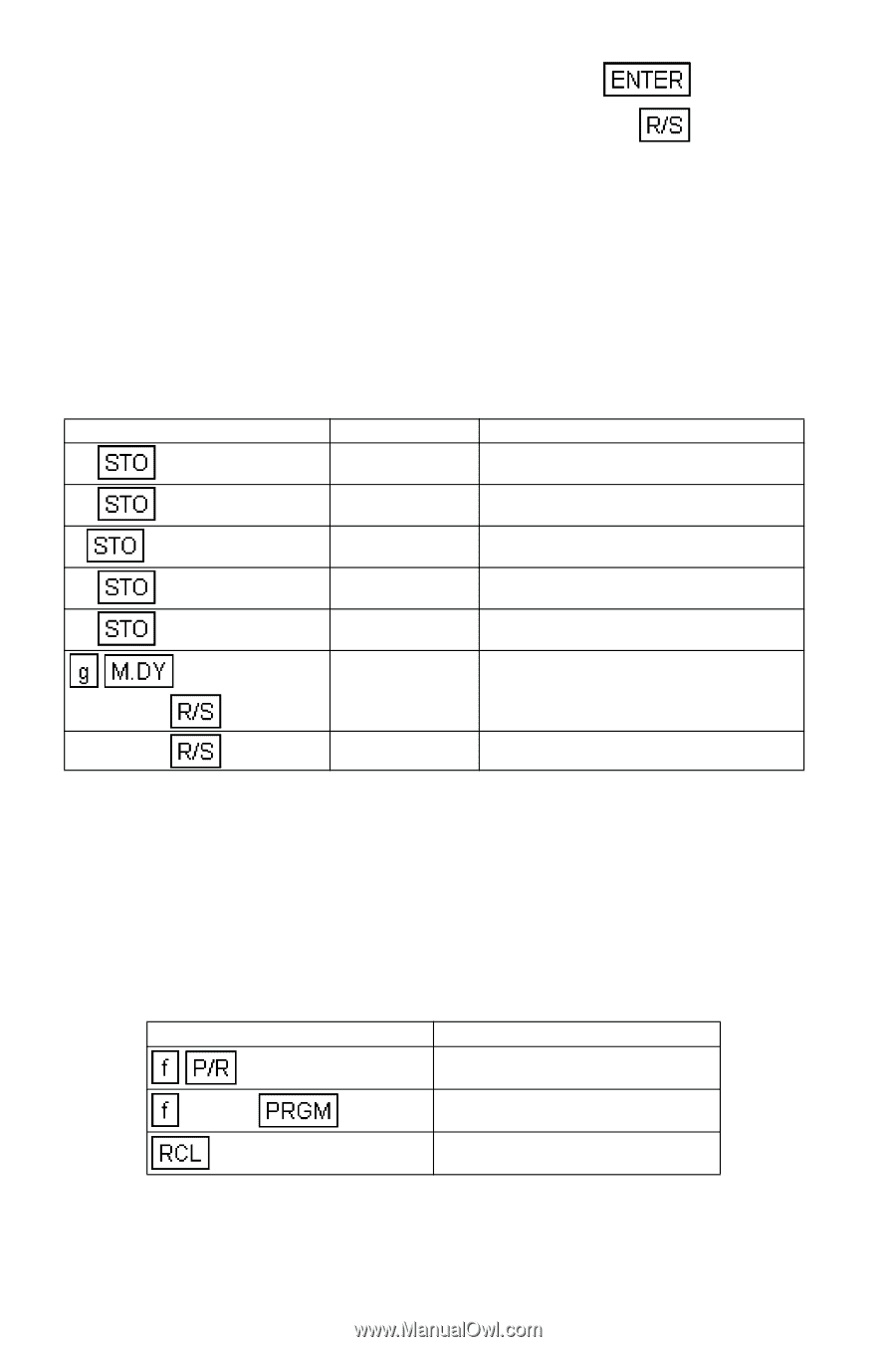

8. Key in the purchase date (MM.DDYYYY) and press . 9. Key in the assumed sell date (MM.DDYYYY) and press to find the after-tax yield (as a percentage). 10. For the same bond but different date return to step 8. 11. For a new case return to step 2. Example: You can buy a 7% bond on October 1, 1981 for $70 and expect to sell it in 5 years for $90. What is your net (after-tax) yield over the 5year period if interim coupon payments are considered as income, and your tax bracket is 50%? (One-half of the long term capital gain is taxable at 50%, so the tax on capital gains alone is 25%) Keystrokes Display 70 1 10.00 Purchase price. 90 2 90.00 Selling price. 7 3 7.00 Annual coupon rate. 25 4 25.00 Capital gains tax rate. 50 5 50.00 Income tax rate. 10.011981 10.011986 10.01 8.53 Purchase Date. % after tax yield. Discounted Notes A note is a written agreement to pay a sum of money plus interest at a certain rate. Notes to not have periodic coupons, since all interest is paid at maturity. A discounted note is a note that is purchase below its face value. The following HP 12C program finds the price and/or yield* (*The yield is a reflection of the return on an investment) of a discounted note. KEYSTROKES DISPLAY CLEAR 1 0001- 45 1 67