HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 7

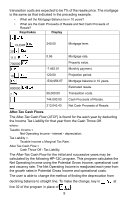

mortgage should be 12% annually. In the previous example, what monthly

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 7 highlights

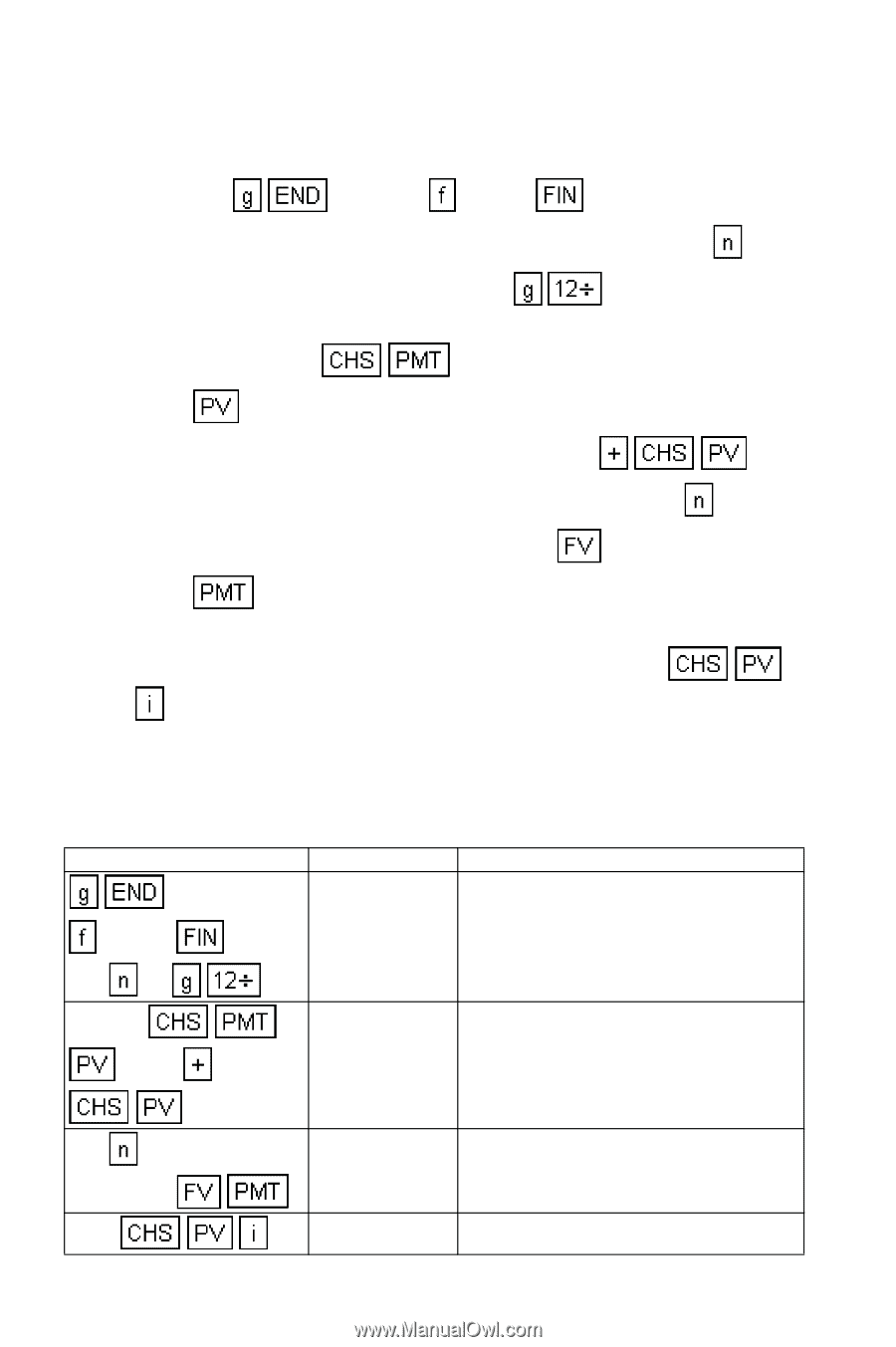

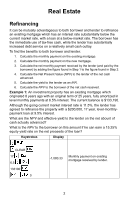

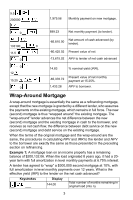

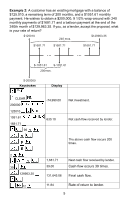

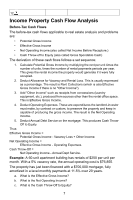

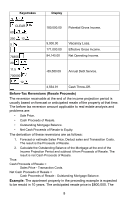

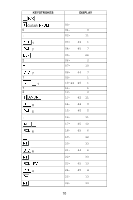

If you, as a lender, know the yield on the entire transaction, and you wish to obtain the payment amount on the wrap-around mortgage to achieve this yield, use the following procedure. Once the monthly payment is known, the borrower's periodic interest rate may also be determined. 1. Press the and press CLEAR . 2. Key in the remaining periods of the original mortgage and press . 3. Key in the desired annual yield and press . 4. Key in the monthly payment to be made by the lender on the original mortgage and press . 5. Press . 6. Key in the net amount of cash advanced and press . 7. Key in the total term of the wrap-around mortgage and press . 8. If a balloon payment exists, key it in and press . 9. Press to obtain the payment amount necessary to achieve the desired yield. 10. Key in the amount of the wrap-around mortgage and press to obtain the borrower's periodic interest rate. Example 3: Your firm has determined that the yield on a wrap-around mortgage should be 12% annually. In the previous example, what monthly payment must be received to achieve this yield on a $200,000 wraparound? What interest rate is the borrower paying? Keystrokes Display CLEAR 200 12 1051.61 74990 Number of periods and monthly interest rate. -165,776.92 Present value of payments plus cash advanced. 240 129963.35 2000 1,693.97 9.58 Monthly payment received by lender Annual interest rate paid by borrower. 6