HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 15

Marginal Tax Rate of 50% and a vacancy rate of 7%, what are the After

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

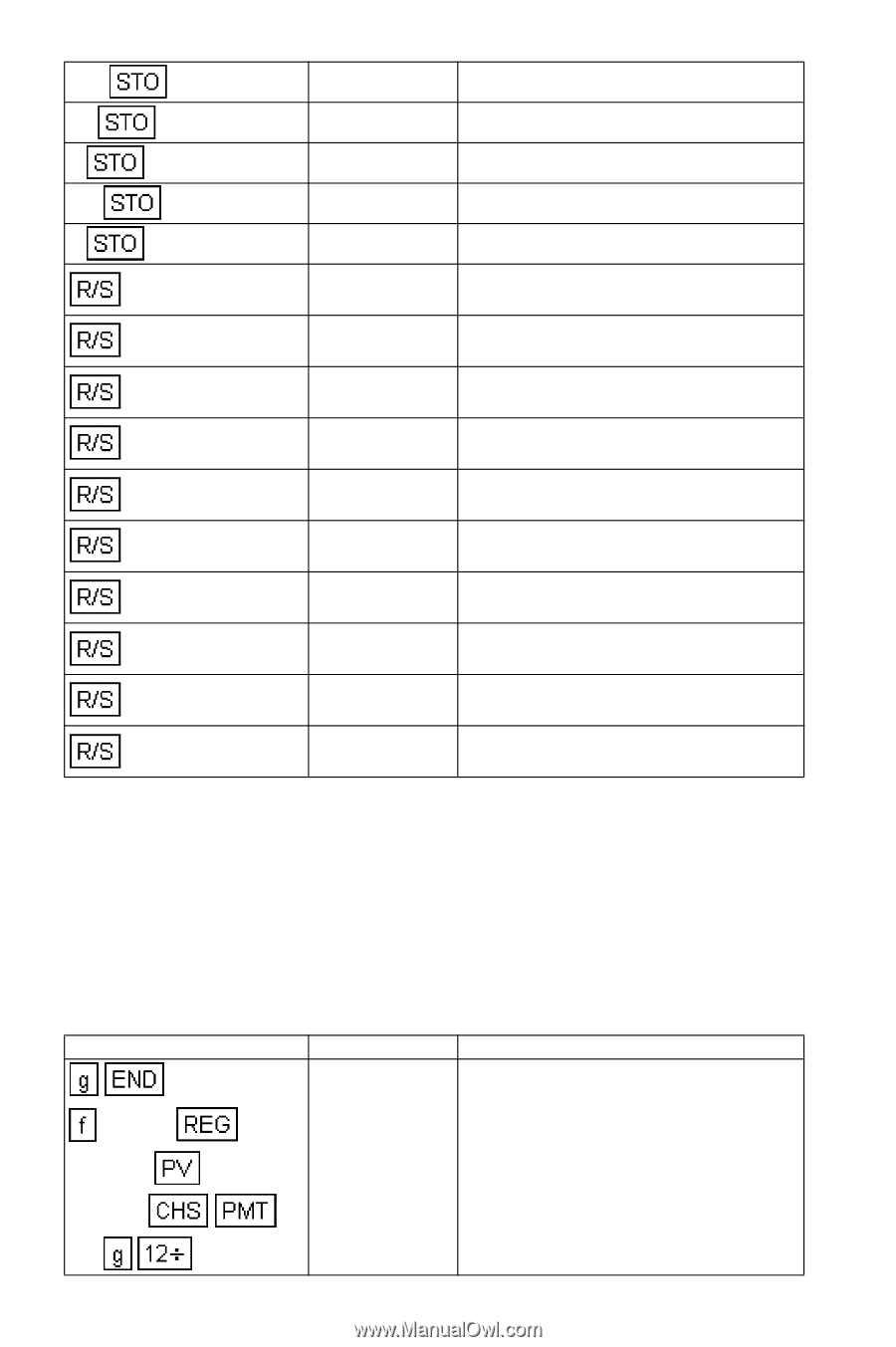

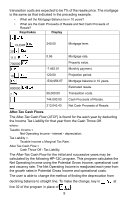

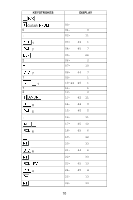

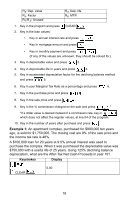

Page 15 highlights

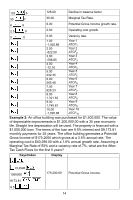

125 6 125.00 Decline in balance factor. 35 7 35.00 Marginal Tax Rate. 6 8 6.00 Potential Gross Income growth rate. 2.5 9 2.50 Operating cost growth. 5 .0 5.00 Vacancy rate. 1.00 Year 1 -1,020.88 2.00 ATCF1 Year 2 -822.59 3.00 ATCF2 Year 3 -598.85 4.00 ATCF3 Year 4 -72.16 5.00 ATCF4 Year 5 232.35 6.00 ATCF5 Year 6 565.48 7.00 ATCF6 Year 7 928.23 8.00 ATCF7 Year 8 1,321.62 9.00 ATCF8 Year 9 1,746.81 10.00 ATCF9 Year 10 -1,020.88 ATCF10 Example 2: An office building was purchased for $1,400,000. The value of depreciable improvements is $1,200,000.00 with a 35 year economic life. Straight line depreciation will be used. The property is financed with a $1,050,000 loan. The terms of the loan are 9.5% interest and $9,173.81 monthly payments for 25 years. The office building generates a Potential Gross Income of $175,2000 which grows at a 3.5% annual rate. The operating cost is $40,296.00 with a 1.6% annual growth rate. Assuming a Marginal Tax Rate of 50% and a vacancy rate of 7%, what are the After- Tax Cash Flows for the first 5 years? Keystrokes Display CLEAR 1050000 9173.81 9.5 175,200.00 Potential Gross Income. 14