HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 34

a. The current year. Then press to continue.

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

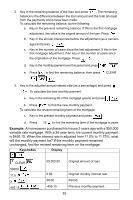

Page 34 highlights

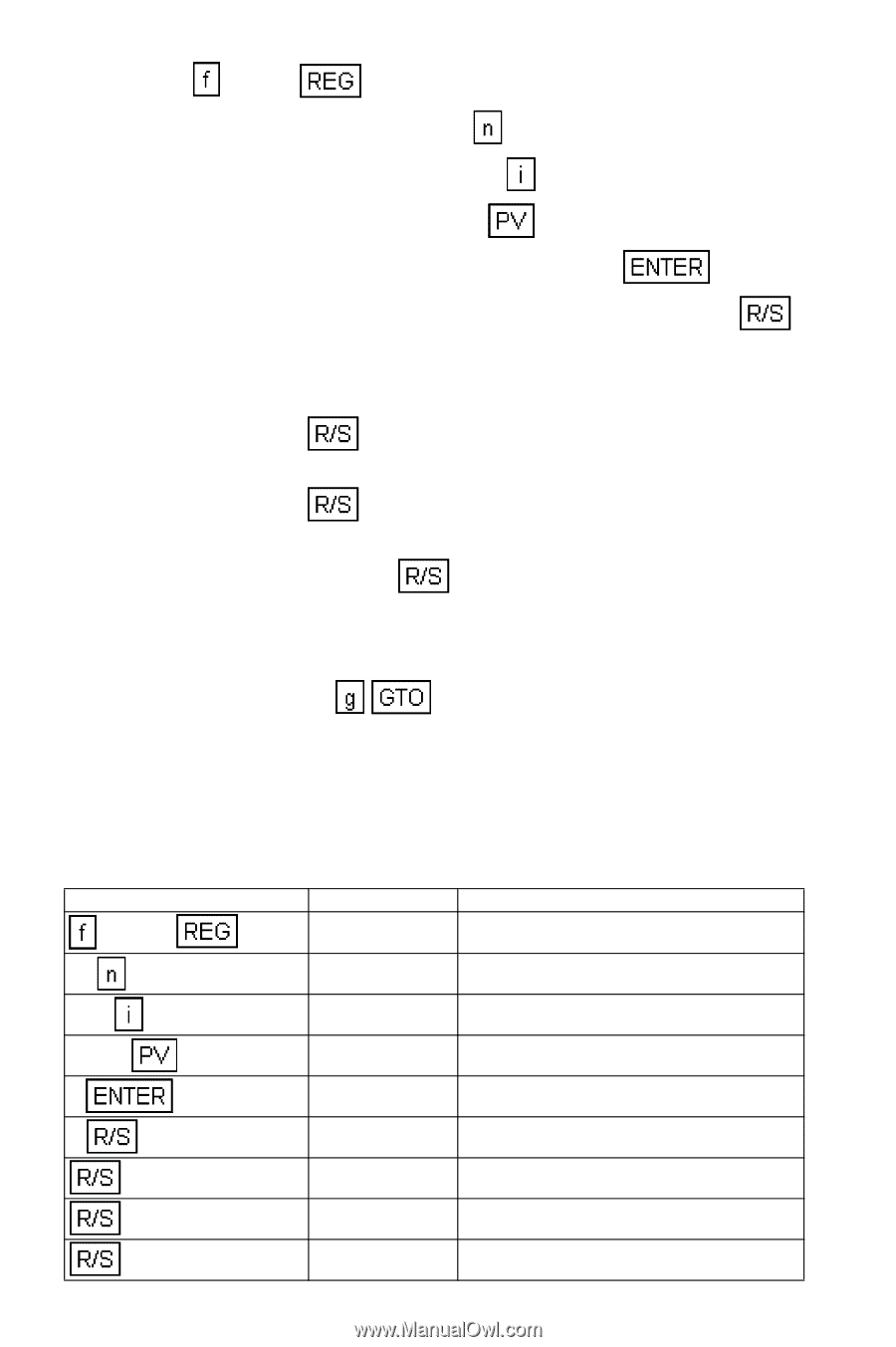

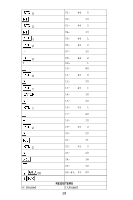

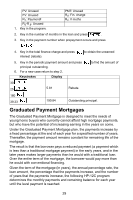

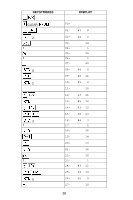

2. Press CLEAR . 3. Key in the term of the loan and press . 4. Key in the annual interest rate and press . 5. Key in the total loan amount and press . 6. Key in the rate of graduation (as a percent) and press . 7. Key in the number of years for which the loan graduates and press . The following information will be displayed for each year until a level payment is reached. a. The current year. Then press to continue. b. The monthly payment for the current year. Then press to continue. c. The remaining balance to be paid on the loan at the end of the cur- rent year. Then press to return to step a. unless the level payment is reached. If the level payment has been reached, the program will stop, displaying the monthly payment over the remaining term of the loan. 8. For a new case press 00 and return to step 2. Example: A young couple recently purchased a new house with a Graduated Payment Mortgage. The loan is for $50,000 over a period of 30 years at an annual interest rate of 12.5%. The monthly payments will be graduating at an annual rate of 5% for the first 5 years and then will be level for the remaining 25 years. What are the monthly payment amount for the first 6 years? Keystrokes Display CLEAR 0.00 30 30.00 Term 12.5 12.50 Annual interest rate 50000 50,000.00 Loan amount 5 5.00 Rate of graduation 5 1.00 Year 1 -448.88 1st year monthly payment. -50,194.67 Remaining balance after 1st year. 2.00 Year 2 33