HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 155

Securities, Forecasting, Profit and Loss Analysis, Discounted Notes, Price given discount rate

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 155 highlights

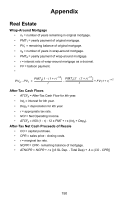

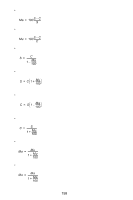

Profit and Loss Analysis • Net income = (1 - tax)(net sales price - manufacturing expense - operating expense) • Net sales price = list price(1 - discount rate) • where operating expense represents a percentage of net sales price. Securities Discounted Notes Price (given discount rate) • B = number of days in year (annual basis). • DR = discount rate (as a decimal). • DSM = number of days from settlement date to maturity date. • P = dollar price per $100 per value. • RV = redemption value per $100 par value. • P = [RV] - DR × RV × D-----S-----M--B Yield (given price) • B = number of days in year (annual basis). • DSM = number of days from settlement date to maturity date. • P = dollar price per $100 par value. • RV = redemption value per $100 par value. • Y = annual yield of investment with security held to maturity (as a decimal). • Y= R-----V-----------P--P × ------B------DSM Forecasting 154