HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 135

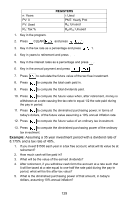

Number of, Shares, Initial, Purchase, Price, Coefficient, Annual, Dividend, Present, Market Price

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 135 highlights

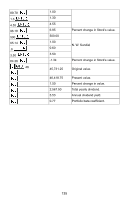

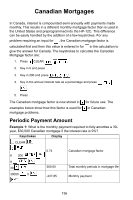

9. Next, to evaluate the entire portfolio, press 48. 10. Press to see the initial portfolio value. 11. Press to see the present portfolio value. 12. Press to see the percent change in value. 13. Press to see the total yearly dividend. 14. Press to see the annual dividend yield as a percent of the current market value. 15. Press to see the beta coefficient of the portfolio. 16. For a new case return to step 2. Example: Evaluate the following portfolio: Number of Shares Held Initial Purchase Price Beta Annual Present Coefficient Dividend Market Price Stock 100 25 5/8 .8 $1.70 27 1/4 Int'l Heartburn 200 30 1/4 1.2 $2.10 33 1/2 P. D. Q. 50 89 7/8 1.3 $4.55 96 1/8 Datacrunch 500 65 1/4 .6 $3.50 64 3/8 N.W. Sundial Keystrokes CLEAR 100 25.58 .8 1.70 27.14 200 30.14 1.2 2.10 33.12 50 Display 0.00 100.00 1.00 0.80 1.70 6.34 200.00 1.00 1.20 2.10 10.74 50.00 Int'l Heartburn Percent change in Stock's value. P. D. Q. Percent change in Stock's value. Datacrunch 134