HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 154

Investment Analysis, Gross Profit.

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 154 highlights

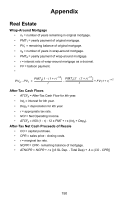

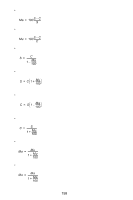

Compounding Periods Different From Payment Periods • C = number of compounding periods per year. • P = number of payments periods per year. • i = periodic interest rate, expressed as a percentage. • r = i / 100, periodic interest rate expressed as a decimal. • iPMT = ((1 + r / C)C/P - 1)100 Investment Analysis Lease vs. Purchase • PMTp = loan payment for purchase. • PMTL = lease payment. • In = interest portion of PMTp for period n. • Dn = depreciation for period n. • Mn = maintenance for period n. • T = marginal tax rate. • k ∑ Net purchasing advantage = -c--c-o--o-s---s-t--tj--f-o-d--f-i--s-l-e-a--a--f--s---id-n---ag----k--(-fn--l--)s---a-----fc--s-o--a-s---(t--f--o,---fx---o-k---w)--F--n---D-i-n---Sg----A-(--n-F---)--F-(1 + i)n n=1 • Cost of owning(n) = PMTp - T(In + Dn) + (1 - T)Mn Break-Even Analysis and Operating Leverage • GP = Gross Profit. • P = Price per unit. • V = Variable costs per unit. • F = Fixed costs. • U = number of Units. • OL = Operating Leverage. • GP = U(P - V) - F • OL = -U----(U---P--(--P-------V-----)V------)---F-- 153