HP 40gs HP 39gs_40gs_Mastering The Graphing Calculator_English_E_F2224-90010.p - Page 156

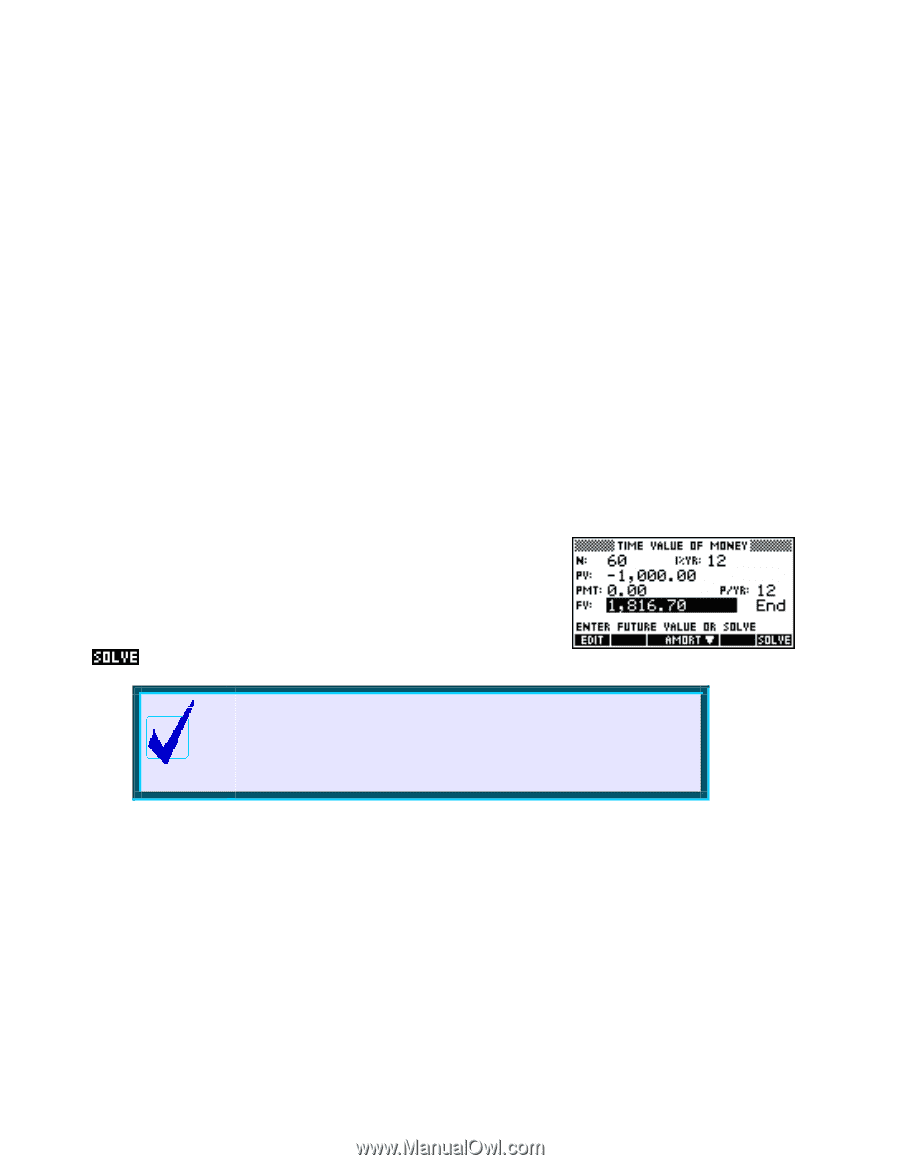

Ordinary compound interest, is 60. The view on the right shows the problem on the calculator.

|

UPC - 882780045217

View all HP 40gs manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 156 highlights

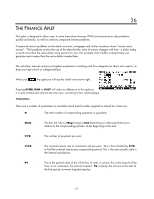

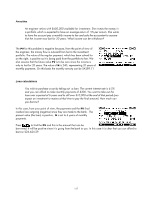

PMT - This is the size of the periodic payment. The assumptions made are that all payments are the same size and that no payments will be skipped. Payments can occur at the beginning or the end of a compounding period, depending on the setting of Mode. FV - The future value of the investment or loan. This could be the amount in a bank account after a period of years, the residual on a lease, the amount still owing on a loan after N repayments, or the remaining value of an investment which has been paying income as an annuity. When using the aplet is it important to visualize the cash flow in terms of positive cash (inwards) or negative cash (outwards). This can be illustrated simply via the following example. Always bear this principle in mind when deciding how to plan your setup of the aplet. Ordinary compound interest Invest $1000 into a bank account paying 6.5% per annum for 5 years. Interest is calculated monthly and credited to the account at the end of each month. What is the investment worth at the end of the period? Looked at from the point of view of the person investing the money, the cash flow is initially outwards (negative) by $1000. The final payment is inwards (positive) and no payments (withdrawals) are made during the period of the investment. Five years of monthly payments means that N is 60. The view on the right shows the problem on the calculator. The button has been pressed to give a future value FV of $1816.70. Calculator Tip As can be seen above, the designers of this aplet chose to display money to 2 decimal places and using comma separators. This choice is independent of the settings in the MODES view. When entering values do not use commas as they will simply result in a syntax error. 156