Konica Minolta bizhub C280 Product Guide - Page 13

Gartner — Market Information (April 2009), April 2009 - for sale

|

View all Konica Minolta bizhub C280 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 13 highlights

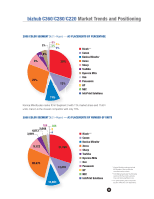

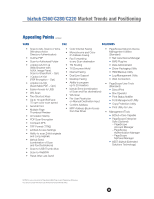

bizhub C360/C280/C220 Market Trends and Positioning Gartner - Market Information (April 2009) Gartner Dataquest acts as a global adviser to technology vendors such as Konica Minolta. They collect and analyze data that is used by manufacturers to study market data and market trends. Among the services that they provide is a yearly forecast of the upcoming months as well as a yearly comparison of sales by segment by manufacturer. Gartner reported that for 2009 the forecast for Color MFPs is for an overall unit growth of 2.5% over 2008. The market is expected to see continuous growth over the next few years. The forecast period (2008-13) will end with a CAGR of 4.0% with the highest growth rates in 2012 and 2013, 5.0% and 5.1% respectively. The 21-30 ppm segment is expected to have negative unit sales CAGR of 1.8%. With small year-over-year declines throughout the 5 year period. The decrease in this segment is mostly attributed to A3 (a product that supports up to 11" x 17" media) MFPs. A4 (a product that supports up to 8.5" x 14" media) machines will see a growth and by 2013 will account for 25% of this segment, up from 17% in 2008. The 31-40 ppm segment will benefit from the upstream movement of the 21-30 ppm products and is expected to see a positive 5.8% CAGR. The introduction of more A4 MFPs to this segment is expected to be a growing trend in the next 5 years. Source: Gartner Forecast Printers Copiers MFPs 2009-2013 - May.2009 25% 20% 15% 10% 5% 0% 11-20 ppm 21-30 ppm 31-44 ppm 45+ ppm 9